15+ Infographic Resume Templates, Examples & Builder

You heard your resume “needs to be eye-candy.” You’ll get what you want. You’ll also get what you need—expert insight into why infographic resumes aren’t for everyone.

Mortality tables? Reserves? Annuities? You’ve got this. Without you, the company would go bankrupt. Prove you’ll fight to keep them solvent with this actuary resume sample.

Writing a good actuary resume is the single most important thing you’ll do this year. Why? Think of it—the hiring manager at Liberty Mutual or Allstate lies awake at night worrying. If she hires the wrong actuary, she could sink her multi-billion-dollar firm overnight. She’s got to know you’re skilled.

Well—you prove things all the time, with numbers. This is no different. You’ll use numbers in your actuarial resume to prove they should interview you ASAP. How? By picking a clean resume format, then loading it like a cohort life table with choice moments from your past. Do it right to boost your present value.

Ready?

You’re about to see an actuary resume example you can change to fit any actuarial role. You’ll also get simple steps to write a resume for actuary jobs that’ll land 10x more interviews than any other.

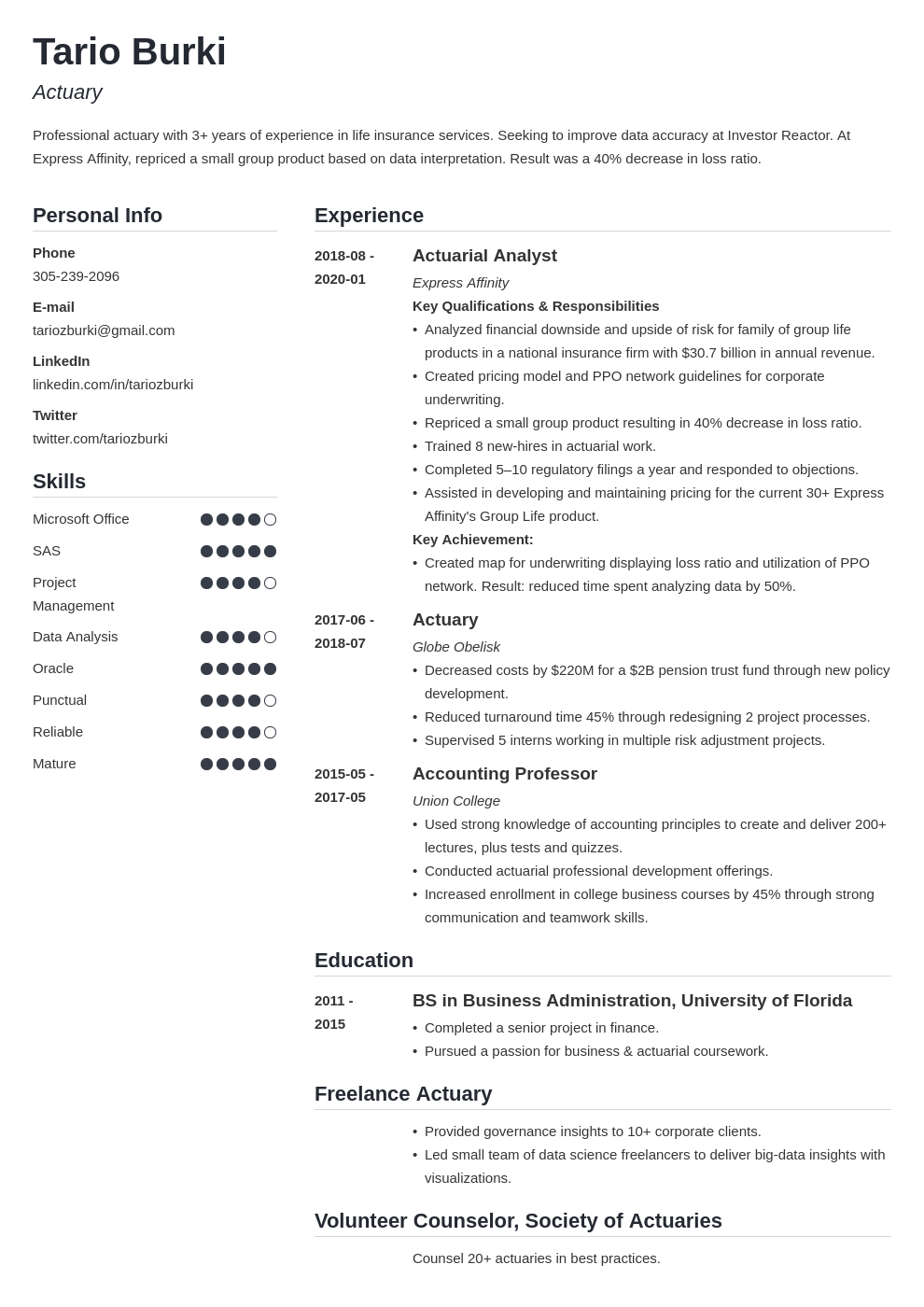

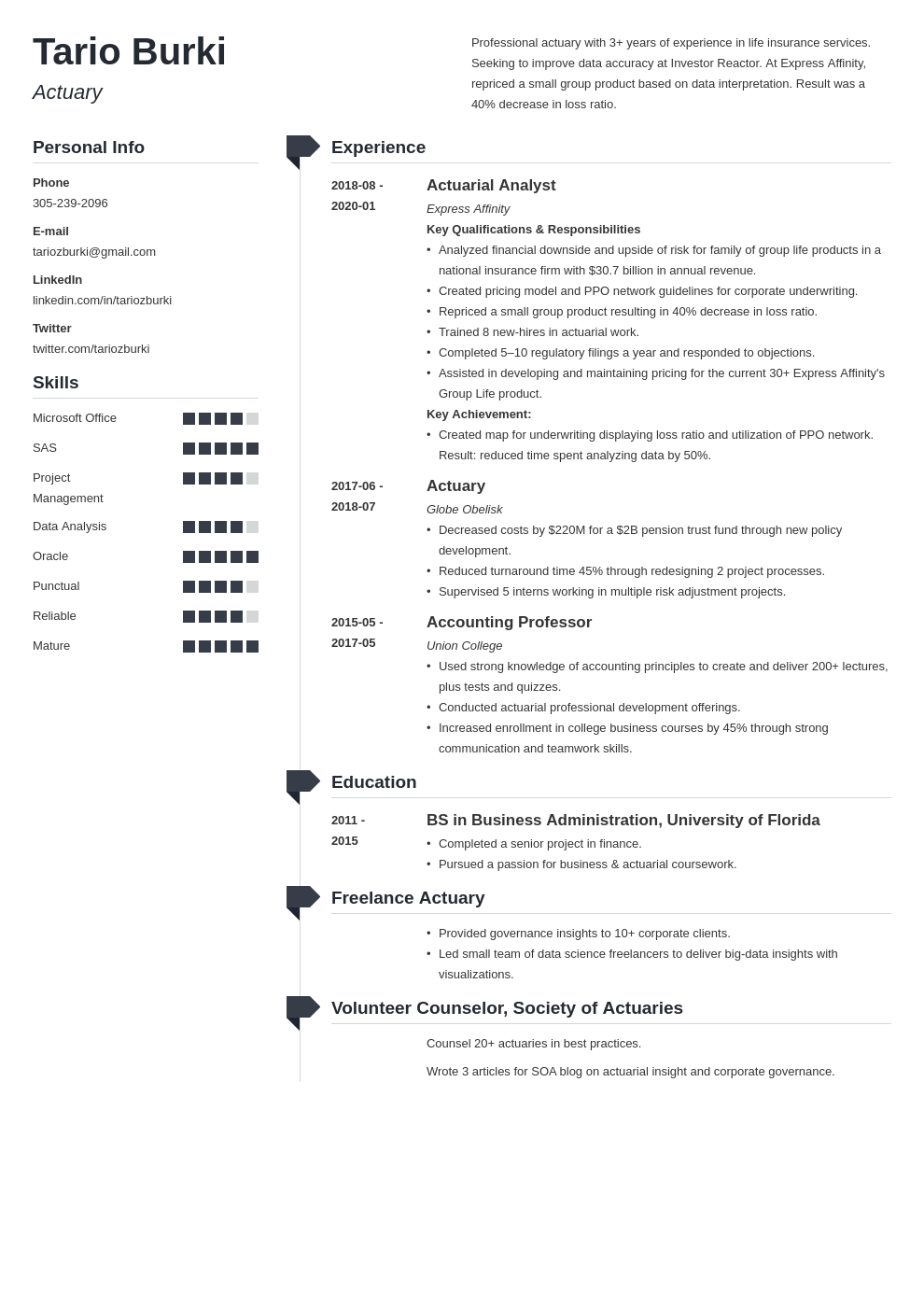

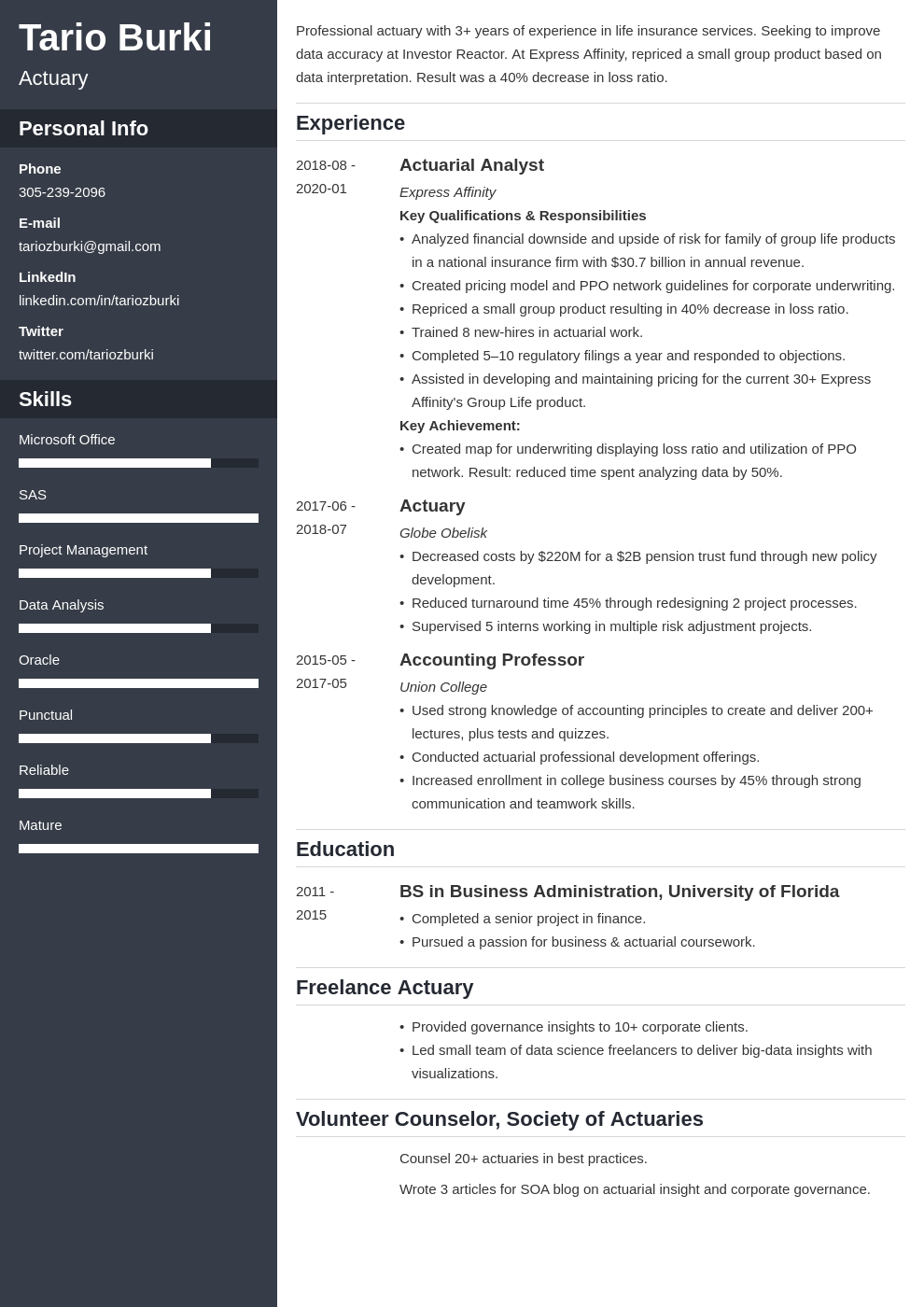

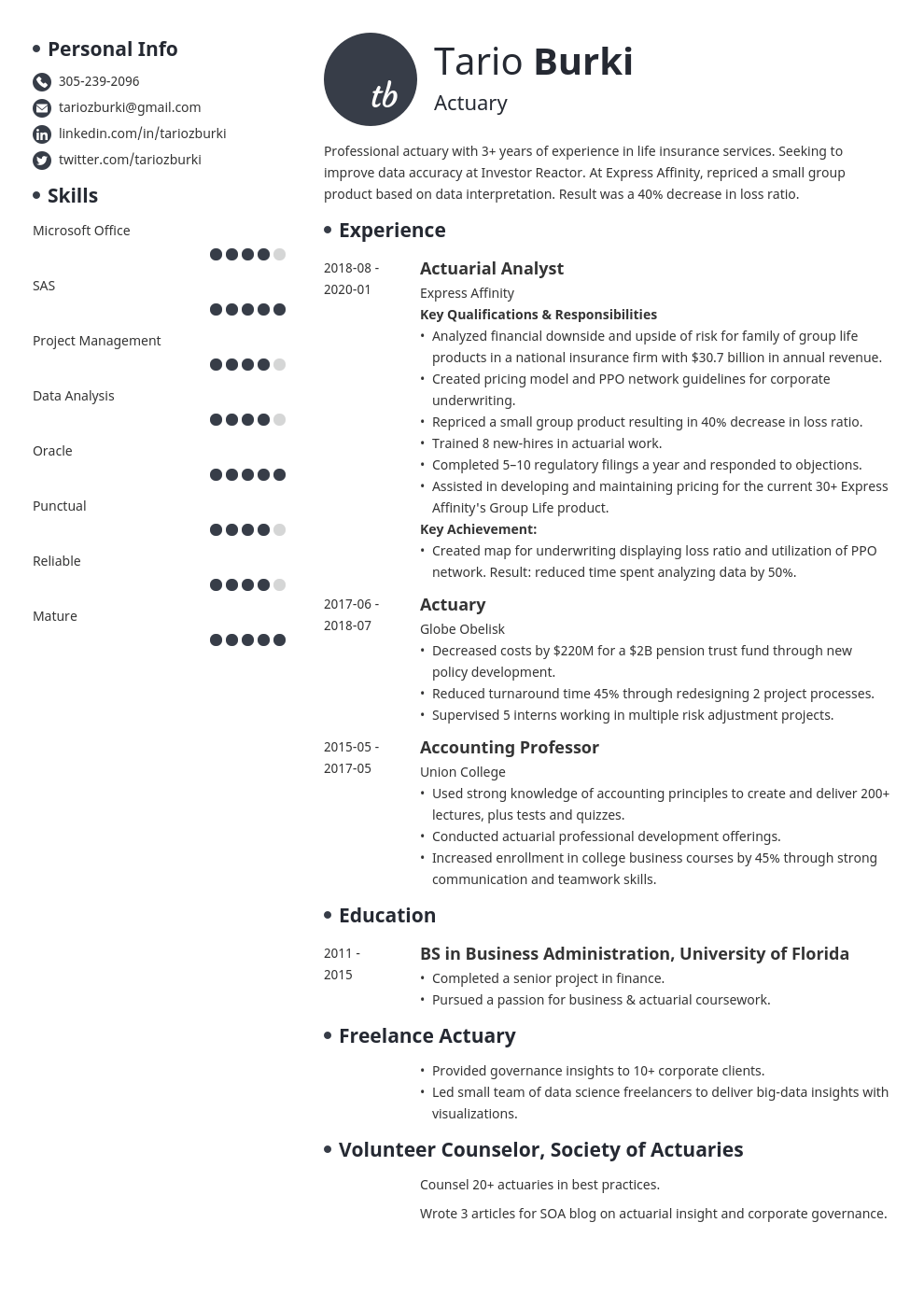

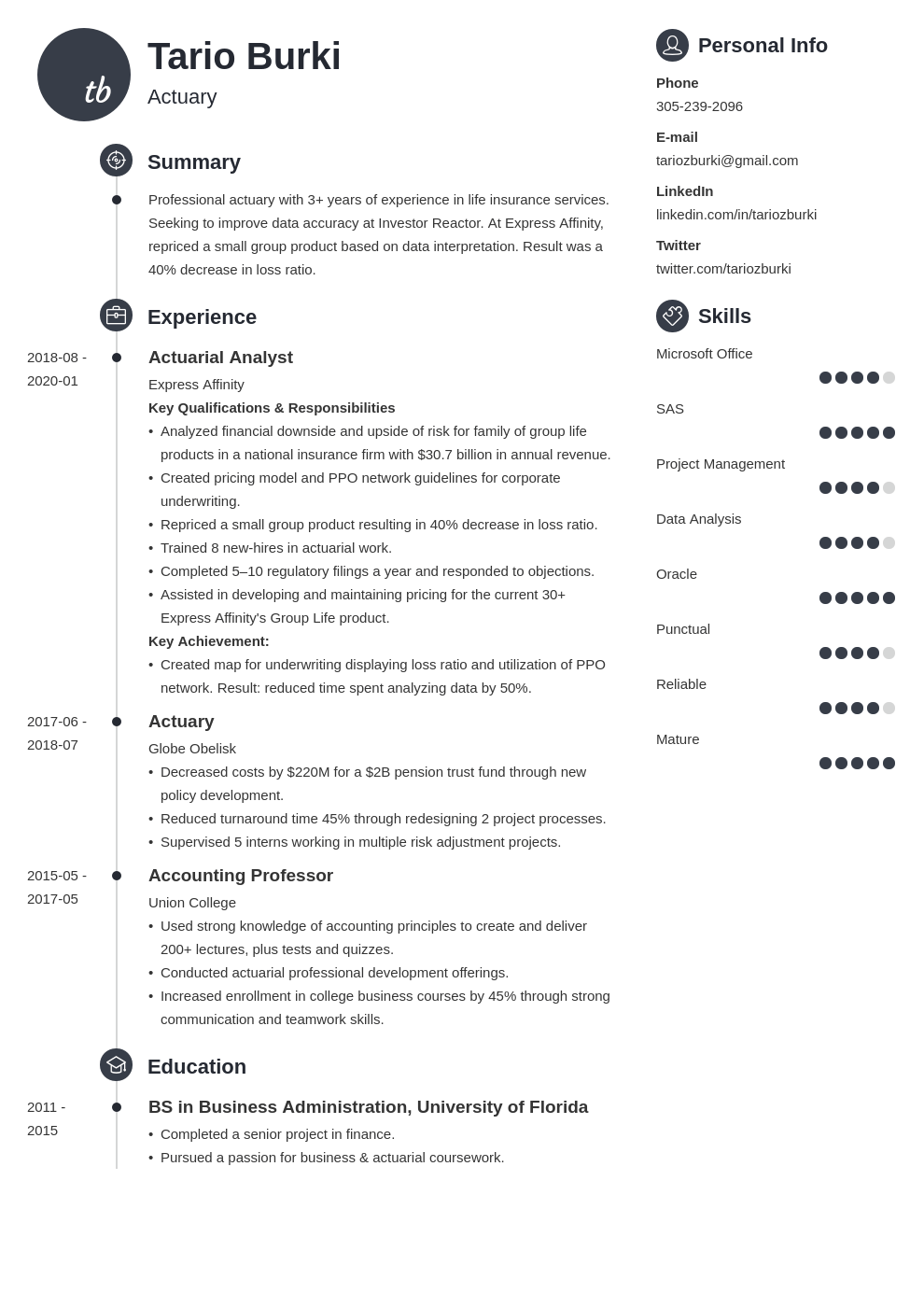

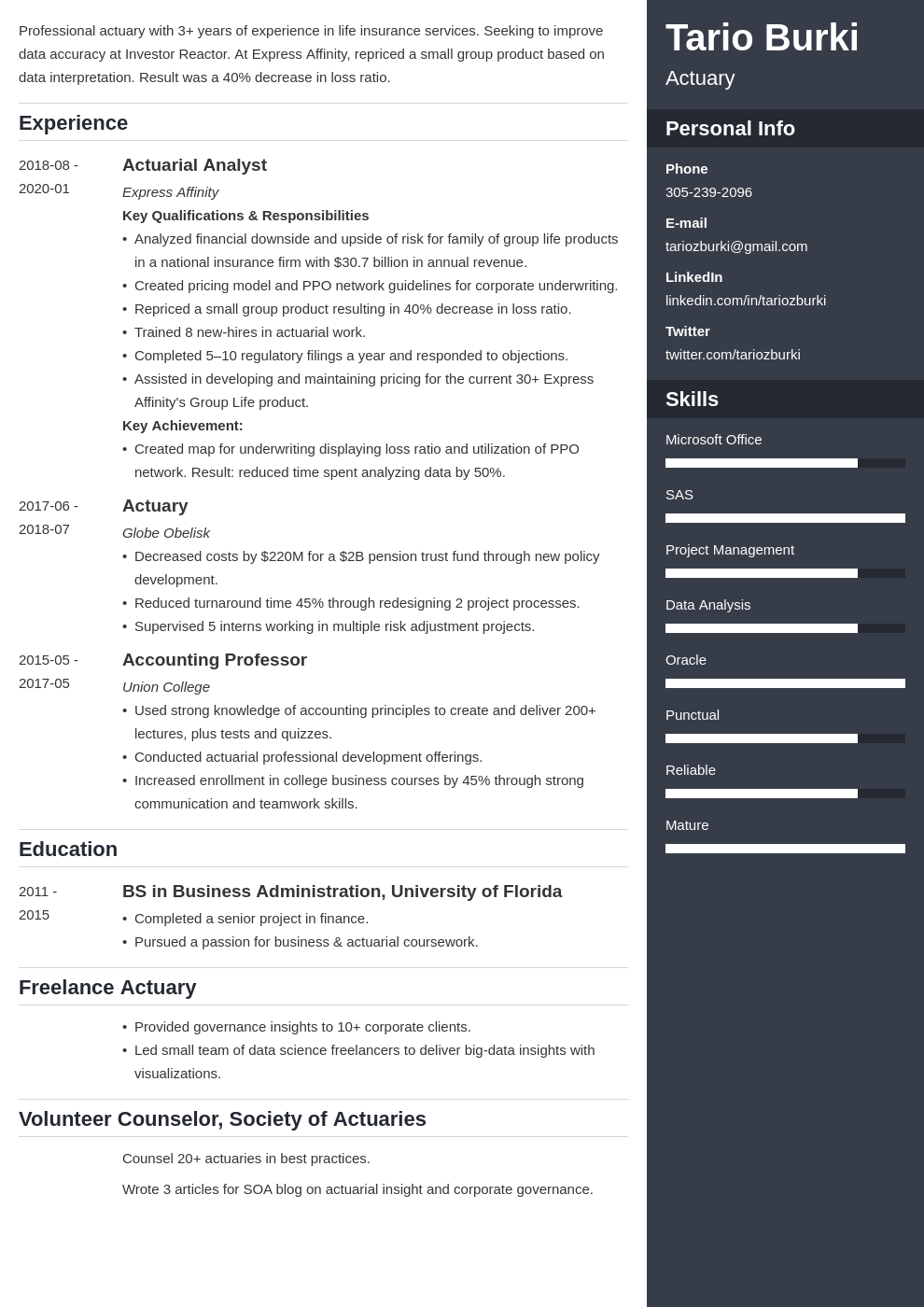

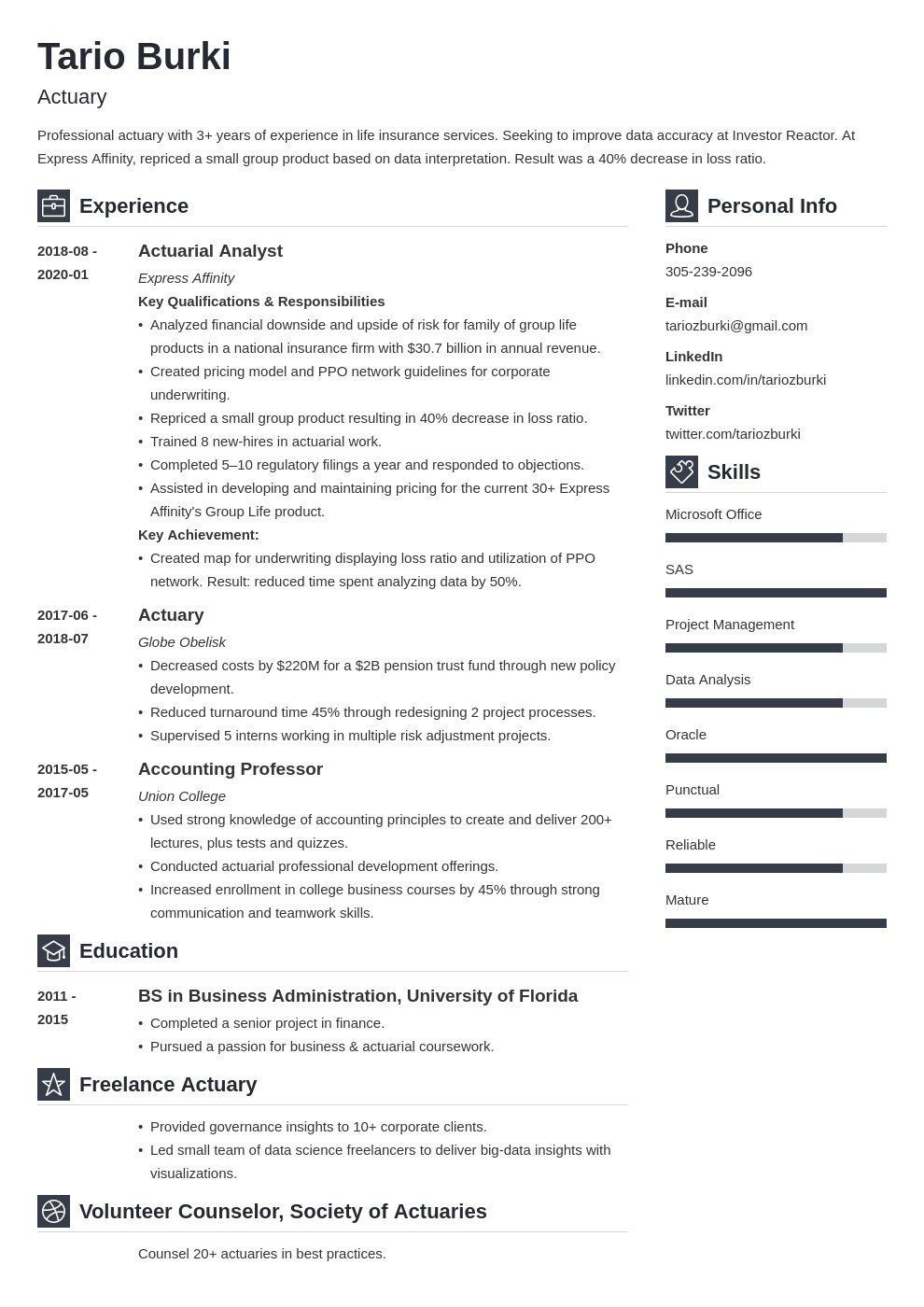

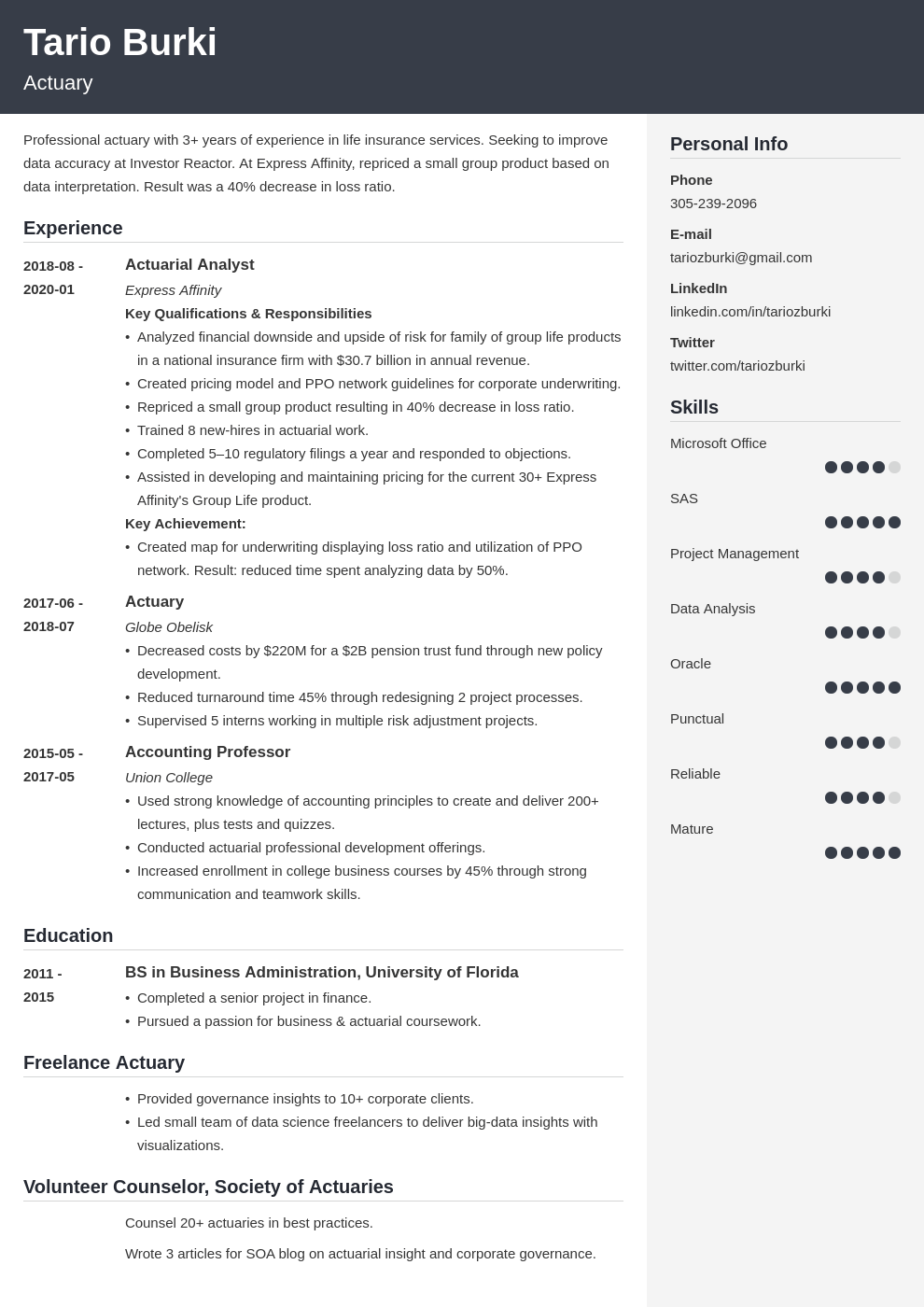

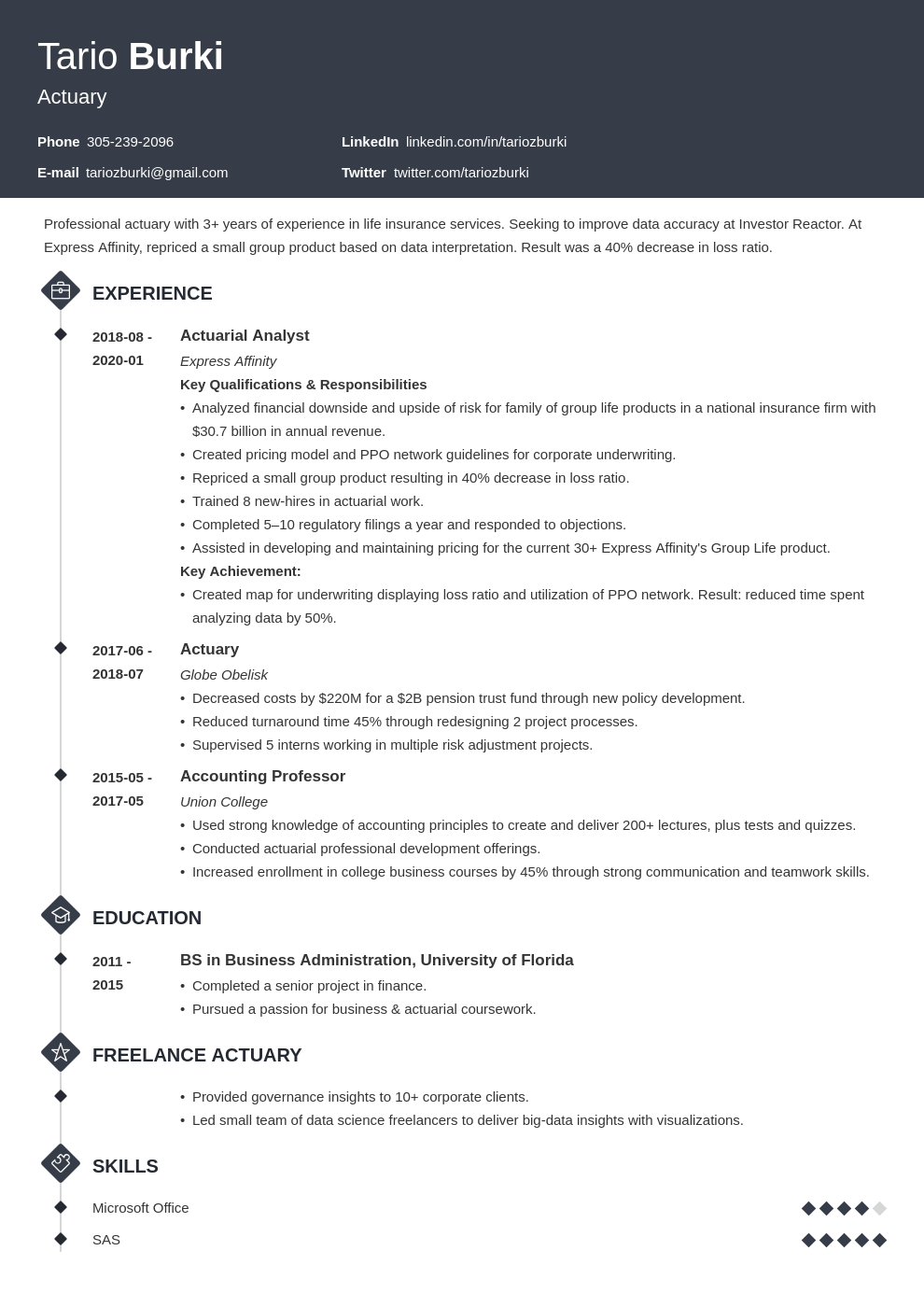

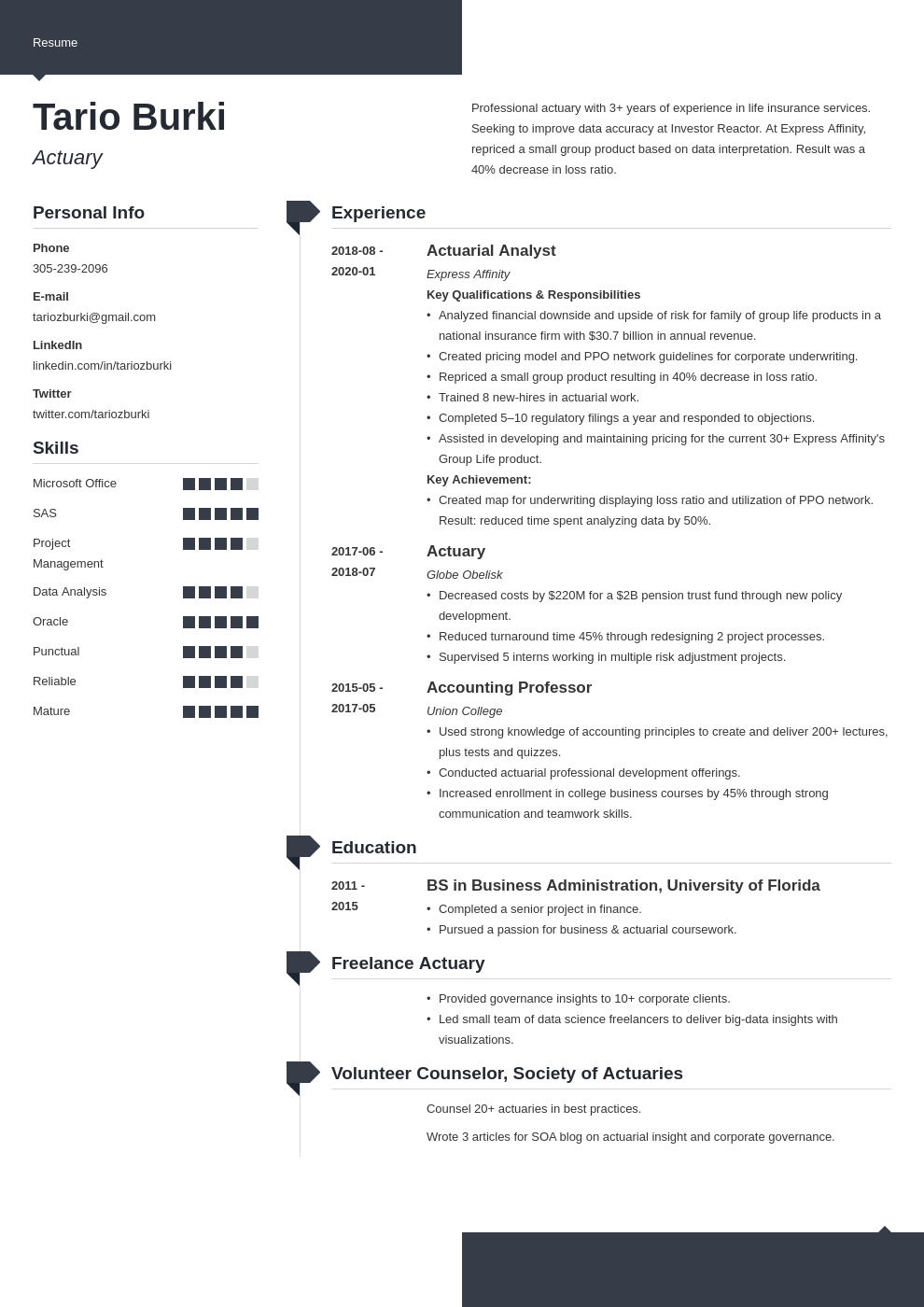

Here’s an actuary resume example made with our builder.

Want to save time and have your resume ready in 5 minutes? Try our resume builder. It’s fast and easy to use. Plus, you’ll get ready-made content to add with one click. See 20+ resume templates and create your resume here.

Sample resume made with our builder—See more resume examples here.

Need a different twist on an actuarial resume? See these guides:

Tario Burki

Actuary

305-239-2096

linkedin.com/in/tariozburki

twitter.com/tariozburki

Professional actuary with 3+ years of experience in life insurance services. Seeking to improve data accuracy at Investor Reactor. At Express Affinity, repriced a small group product based on data interpretation. Result was a 40% decrease in loss ratio.

Experience

Actuarial Analyst

Express Affinity

Aug 2018–Jan 2020

Key Qualifications & Responsibilities

Key Achievement:

Actuary

Globe Obelisk

June 2017 to July 2018

Accounting Professor

Union College

May 2015 to May 2017

Education

BS in Business Administration, University of Florida

2011-2015

Skills

Volunteer Counselor, Society of Actuaries

Freelance Actuary

Here’s how to write an actuary resume step-by-step.

You’d never deliver a payout schedule in an MS Notepad doc. Why not? Because your boss would think you don’t know the difference between indemnity and exposure. The same goes for hiring managers. If your actuarial resume isn’t properly formatted, you’ll look like a Geico woodchuck.

Don’t worry. We’ve got the steps below.

Here’s how to format a clean resume template:

Include these parts of a resume:

Think the chronological resume format is too risky? See our guide: How to Pick the Best Resume Format

Here’s the fastest way to kill your job search—make a cookie-cutter work history. What does that mean? If you paint a generic picture of past jobs, your phone will stay as silent as the grave. An actuary resume needs to show big wins that saved the company Scrooge-McDuck-sized piles of cash.

See these actuary resume samples:

| Right |

|---|

Experience

Actuarial Analyst Express Affinity Aug 2018–Jan 2020 Key Qualifications & Responsibilities

Key Achievement:

|

| Wrong |

|---|

|

Astounding. The second actuarial resume example says what you handled and were responsible for. But did you pass or fail? Who knows from those bullet points? But that first one is high-confidence. We know the job you did, and that you trained 8 hires. You did 5+ filings and cut analysis time by 50%. That’s gold!

Writing an entry-level actuary resume? Work the same trick. No—you don’t have actuarial experience. But you have some kind of experience. Pack your bullets with the closest tasks and successes you can think of that fit actuarial job duties. Even a car wash attendant can show interpersonal skills.

See these entry-level actuary resume examples:

| Right |

|---|

Accounting Professor Union College May 2015 to May 2017

|

| Wrong |

|---|

Accounting Professor Union College

|

That first actuarial resume example is zero-risk. We know you haven’t worked as an actuary yet. But you were within estimating distance. You showed transferable skills. Plus—you packed them with numbers that make your case like a longevity illustrator.

Pro Tip: Use more bullet points in your more recent jobs. Use fewer in older ones. The hiring team doesn’t really care what you did five years ago. They care about today.

When making a resume in our builder, drag & drop bullet points, skills, and auto-fill the boring stuff. Spell check? Check. Start building a professional resume template here for free.

When you’re done, Zety’s resume builder will score your resume and tell you exactly how to make it better.

Do gaps matter in an actuary resume? See our guide: How to Show Experience on a Resume

How should you show education in an actuarial resume? Here’s the thing—if you’ve been a working actuary for the past five years, your schooling doesn’t carry as much weight. But you should still use it to your advantage. With the right actuarial successes in your education section, you can get more interviews.

See these actuary resume examples:

| Right |

|---|

Education BS in Business Administration, University of Florida 2011-2015

|

That’s risk-free. It shows you’ve got the degree—but it pins the hiring teams eyes to the page with real-world skills proof.

Pro Tip: In an entry-level actuary resume, your education section can take up half the page or more. Show your projects, classes, groups, clubs, and other wins.

Should you put education first in an actuarial resume with no experience? See our guide: How to Put Your Education on a Resume

What’s more deadly than smoking and car accidents to your career? Putting the wrong skills in an actuary resume. Let’s say you prove your chops beyond a shadow of a doubt, but the hiring manager—Pete—yawns and says, “Who cares?” You need to target your skills like a period life table to get hired.

So—

Start with this list of skills for actuarial resumes:

But which ones will make the offers roll in?

Here’s how to pick the best actuary skills:

See this actuarial resume example:

Say the firm wants policy development, process design, and training.

| Right |

|---|

|

Pow. Done. Sold. Actuary skills on a resume like that will leave them standing. Notice we used resume power words to get attention like The Travelers. Plus you said $220M, $2B, 75%, and 5. Those numbers make it sizzle!

Pro Tip: Can’t zero in on the right skills in the job ad? Some postings don’t list skills clearly. So, do informational interviews with actuaries and managers in the firm.

What’s better in an actuarial resume? Active listening or leadership? See our guide: +30 Best Examples of What Skills to Put on a Resume

You’re on the home stretch, but let’s not set the limit yet. If you really want the job (hint: you do) then you need a couple other sections. Why? Because hiring managers in big insurance firms want to know you won’t flake out in a few months. They don’t have an actuarial table for that, but you can give them one.

Do add achievements to your resume like:

What certifications look great on an actuary resume? Well—you don’t actually need any of them. But if you’re as green as fresh-minted currency, they’ll give you a head start. Consider:

Have you done some finance work for your local homeless shelter? Run food drives? Delivered meals to the disadvantaged? Those things show you’ve got so much energy a mere job is not enough. List ‘em if you’ve got ‘em.

Show you dig into your career with affiliations in SOA or IAAI. This works even better if you’re active in volunteering, mentoring, or teaching.

Did you go to RAA last year or do you think about attending the SOA Refocus Conference? That’s a great way to show you’ve got boundless energy and enthusiasm for your work.

Did you get the nod from the SOA in a research competition? How about a kudo from your company or boss? Spotlight those in your actuarial resume.

See these actuary resume samples:

| Right |

|---|

Volunteer Counselor, Society of Actuaries

Freelancer

|

| Wrong |

|---|

|

The right example shows how you write an eye-catching resume.

Pro Tip: How long is a resume for actuary jobs? Write a 1-page resume unless you’re more accomplished than David Long. Cut the fat to make it lean and mean.

Making a resume in MS Word? It’s time-consuming if you don’t know the right steps! See our guide: How to Make a Resume in Word: Step-by-Step Guide

You already know most managers can’t be bothered to read more than a paragraph. That’s why you take care to summarize your findings. It’s the same with an actuary resume. Sum up the highlights of your resume in a short statement at the top. It needs info like years of experience and key skills.

Here’s how to write a career summary:

These actuarial resume career summary examples show how:

| Right |

|---|

Professional actuary with 3+ years of experience in life insurance services. Seeking to improve data accuracy at Investor Reactor. At Express Affinity, repriced a small group product based on data interpretation. Result was a 40% decrease in loss ratio. |

| Wrong |

|---|

A highly motivated and financially creative actuary who has extensive actuarial experience and knowledge. Committed and skilled in life insurance, annuities, and retirement-related services. Self-motivated but most comfortable in a team-oriented environment. |

What just happened? The first candidate ate the second one for brunch, that’s what. But they’ve got identical skill sets, and either would make a great new hire. The key? Detail like 3+, 40%, and using the company’s name. We suspect that applicant puts her money where her mouth is.

Write a career objective in an entry-level actuary resume. That sounds fancy, but it’s the same thing with a different slant. Namely, you can’t list 3+ years of actuarial achievements. So—add achievements from the jobs you did have. Just make sure they’re as finance-related as possible.

See these actuarial resume examples:

| right |

|---|

Insightful actuary with skills in presentation, data analysis, and teamwork. Seeking to provide key business insights at Globe Obelisk. As accounting professor at Union College, created and delivered 200+ lectures, including actuarial professional development classes. |

| Wrong |

|---|

Entry-level actuary with extensive knowledge of life insurance, mutual funds, and asset management. Excellent communication skills and strong quantitative/qualitative research and statistical analysis. Can easily work individually and within a team. |

Something’s rotten in Denmark. We know neither of those two actuarial job applicants has experience. But we also know candidate #1 has the skills. The second one is “entry-level”, but somehow also skilled in everything finance-related. That’s magical thinking.

Pro Tip: Ugh, they want a video resume. That’s terrifying, but you can do it. The key? Don’t DIY it. Hire a professional with a track record of making successful video resumes.

Just getting into actuarial work? See our guide: First Resume with No Work Experience

Let’s set the record straight. Actuary resumes do need cover letters. Skip it, and you’ll halve the probability of getting hired. That’s according to our HR statistics report. But you can’t just say, “Here’s my actuarial resume, thanks.” You’ve got to show your personality fits the job like an SQL query.

To write a cover letter:

Pro Tip: Writing a cover letter is soooo much easier with a template. Cover letter templates save time and help you complete all the right steps, fast.

Your middle paragraph is everything. See our guides: How To Write A Cover Letter in 8 Steps and How to Make a Resume: A Step-by-Step Guide

Plus, a great cover letter that matches your resume will give you an advantage over other candidates. You can write it in our cover letter builder here. Here's what it may look like:

See more cover letter templates and start writing.

Here’s a recap of how to write an actuary resume:

That’s it! Now, we’d love to hear from you:

Let’s chat below in the comments, and thanks for reading!

You heard your resume “needs to be eye-candy.” You’ll get what you want. You’ll also get what you need—expert insight into why infographic resumes aren’t for everyone.

A career change resume sample that gets jobs. Get 20+ great examples and job-winning tips from our experts. Read our complete guide to writing a professional resume for career changers: highlight your relevant skills and achievements, get a lot more interviews, and kick-start a new career!

Check out the best blank resume templates. Pick a resume form, fill in the blanks. Have your resume ready in 5 minutes. Download your resume as PDF.