Data Entry Cover Letter Sample for Clerk With Any Experience

You’re Speed-Typist of the Year ready to take on large volumes of data with 100% accuracy. And your cover letter will prove this to your next employer.

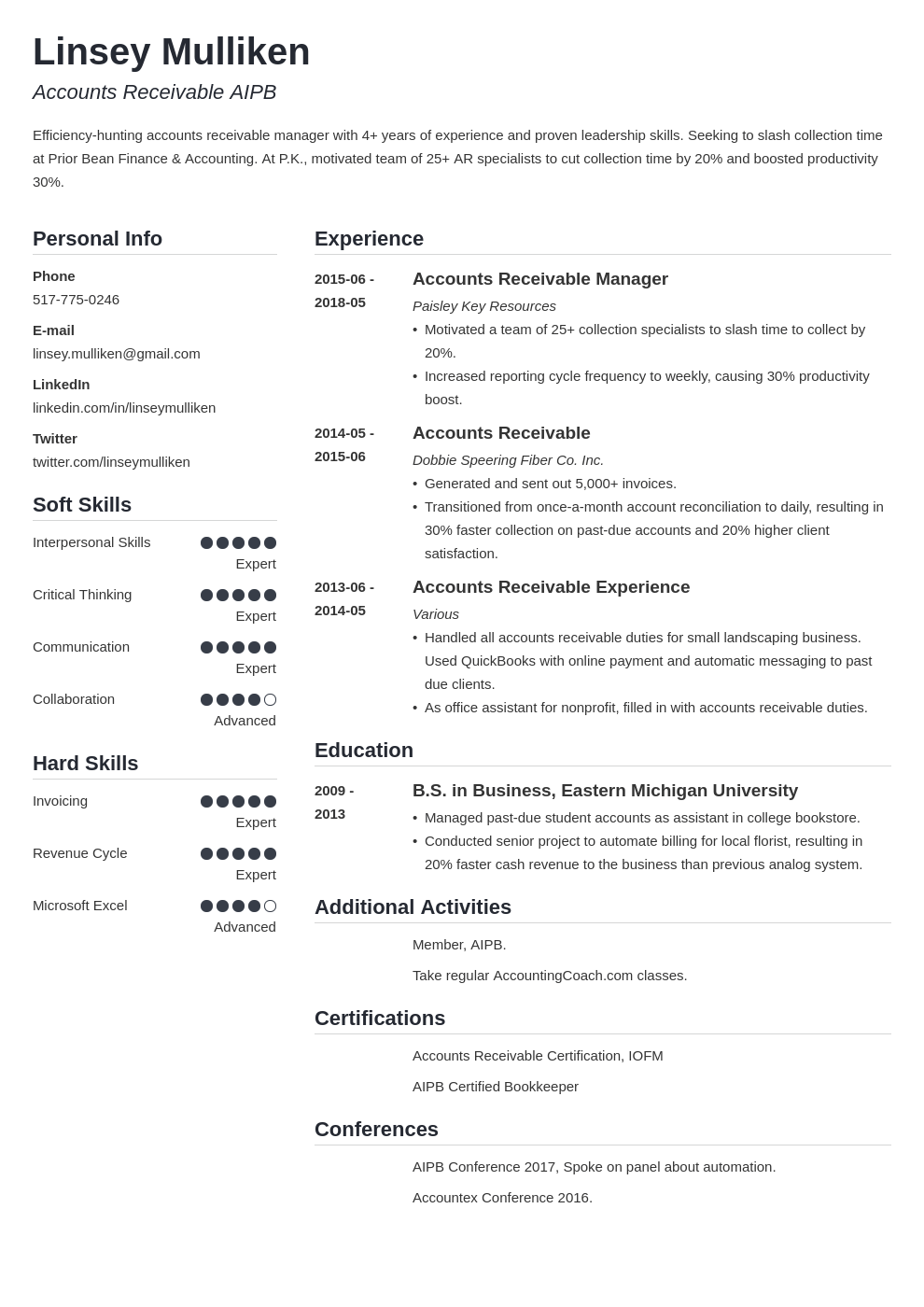

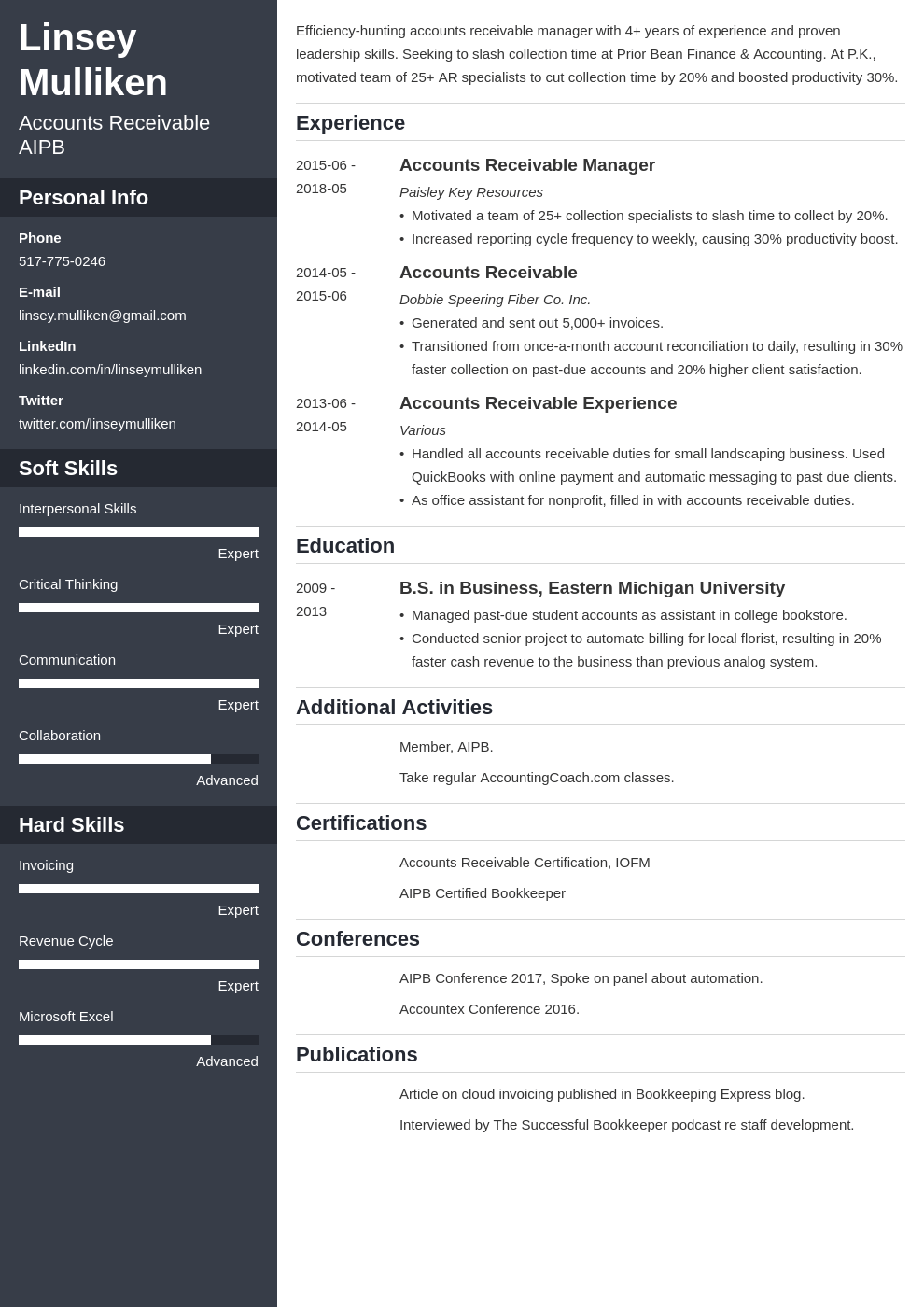

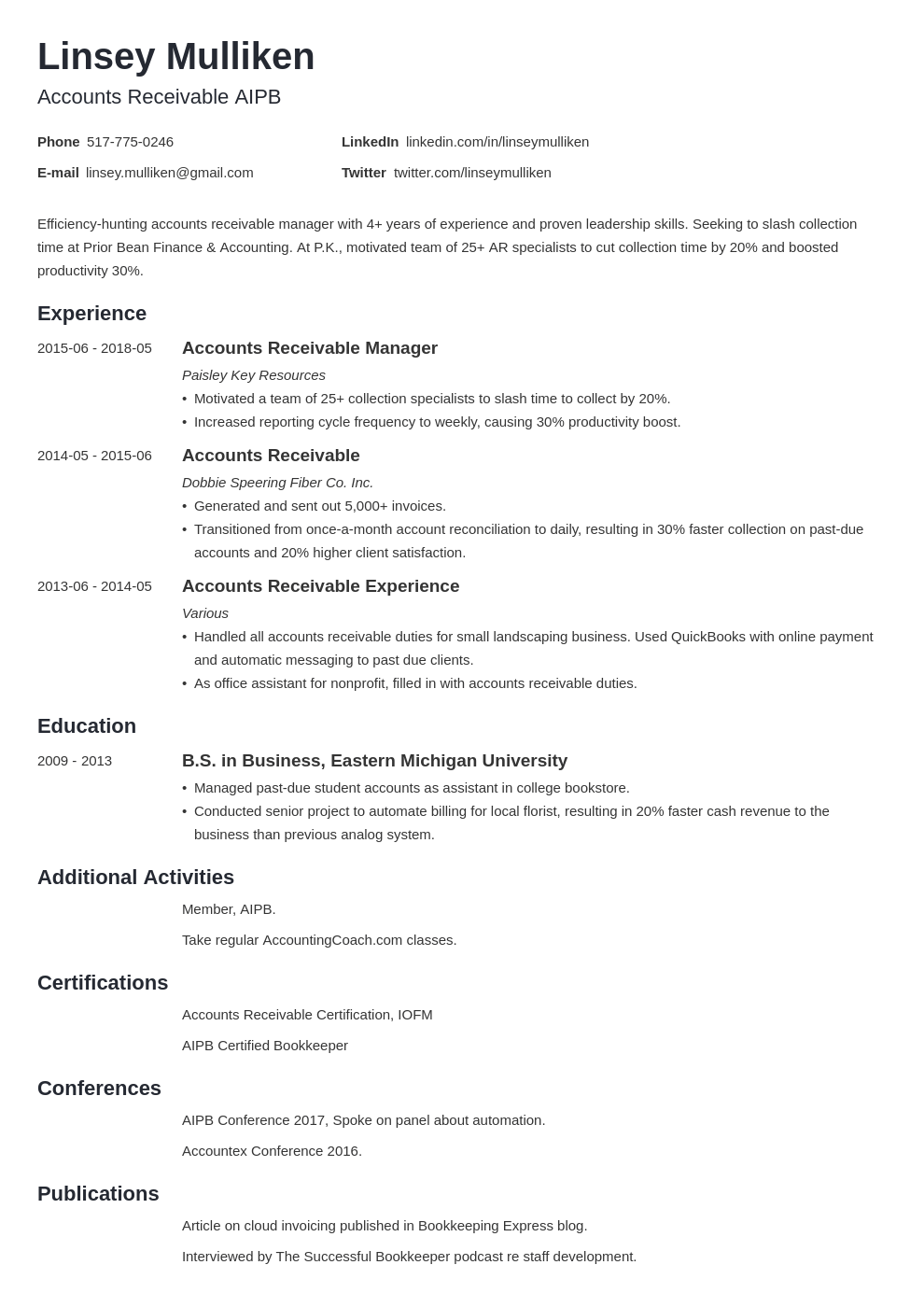

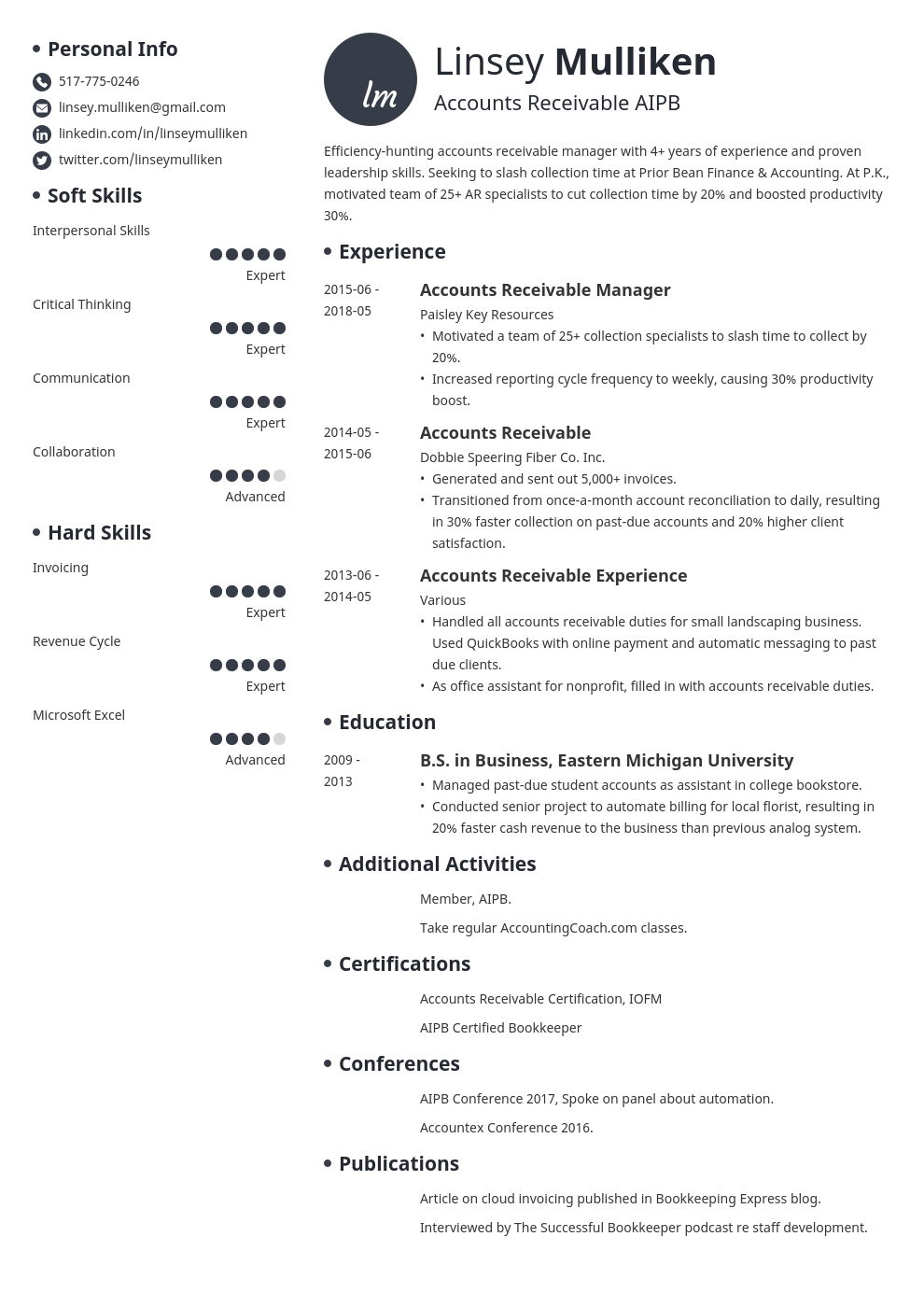

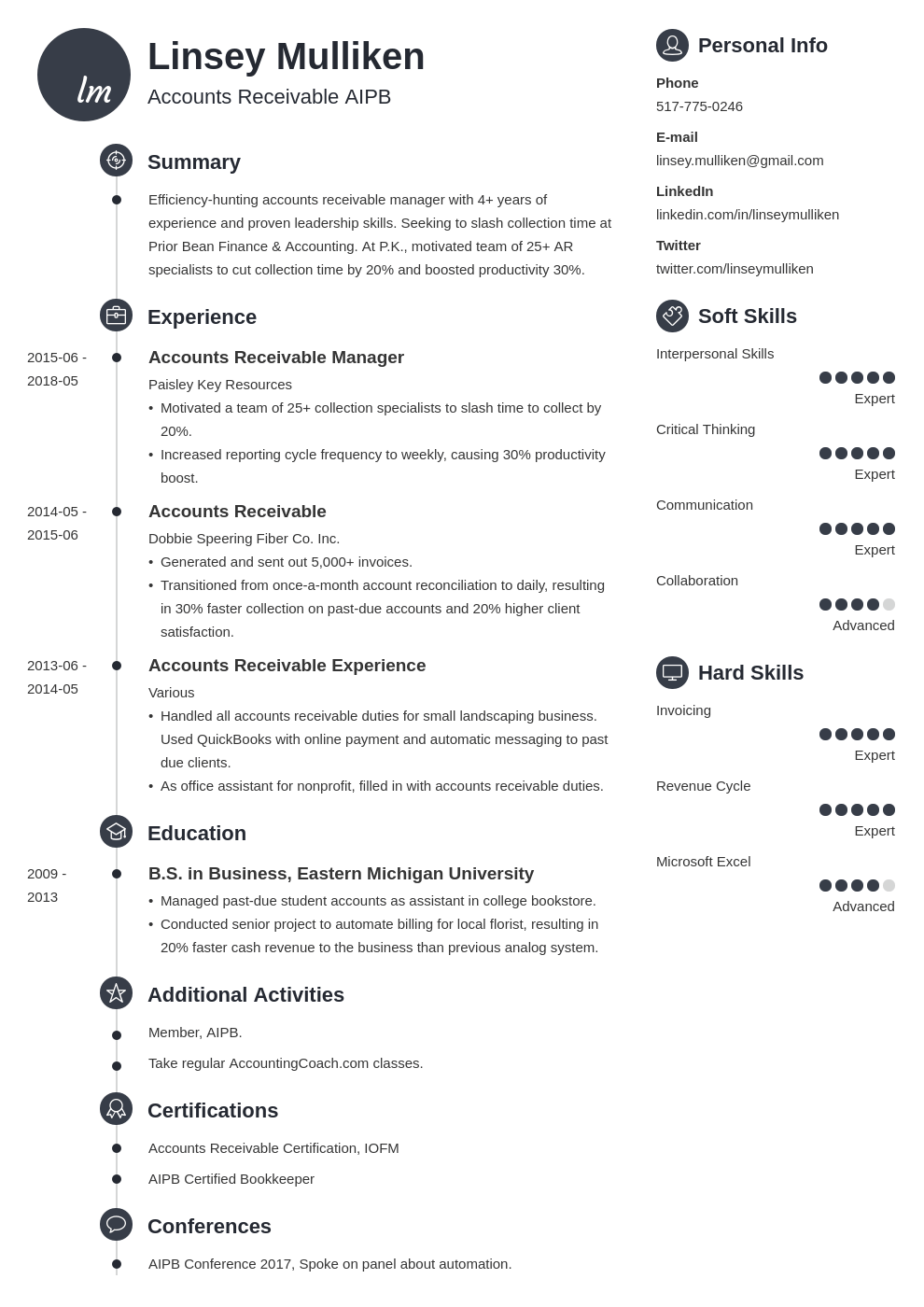

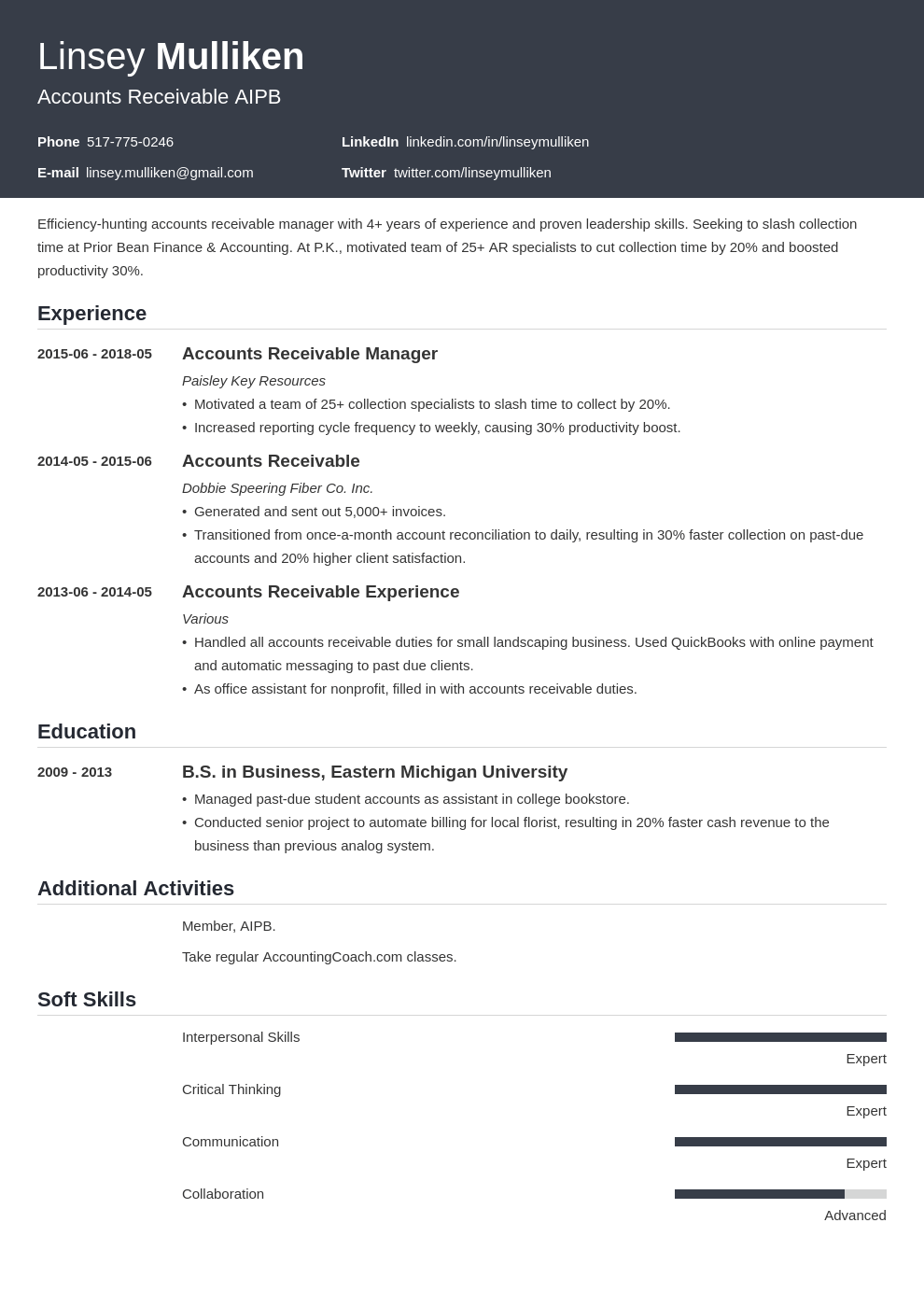

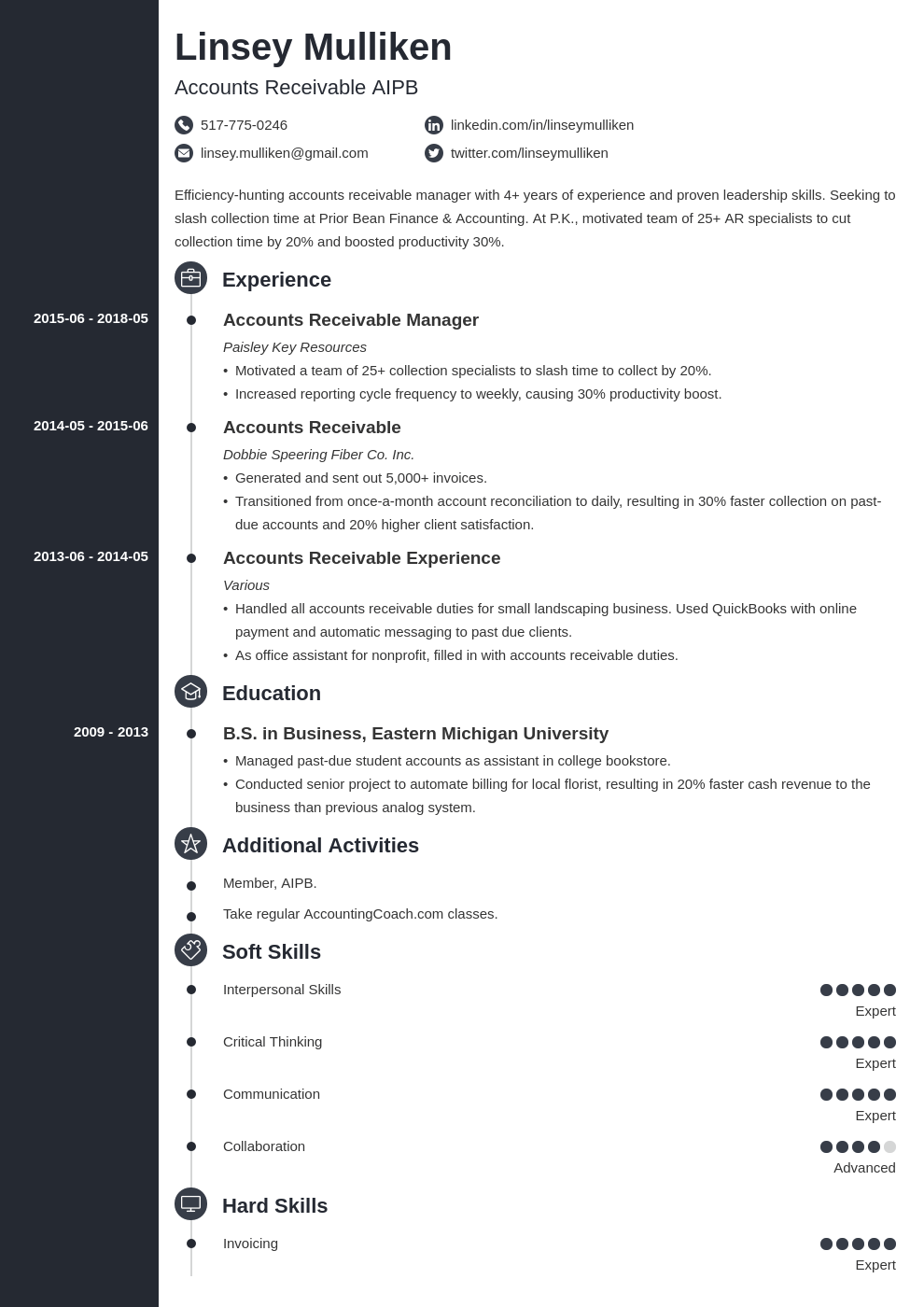

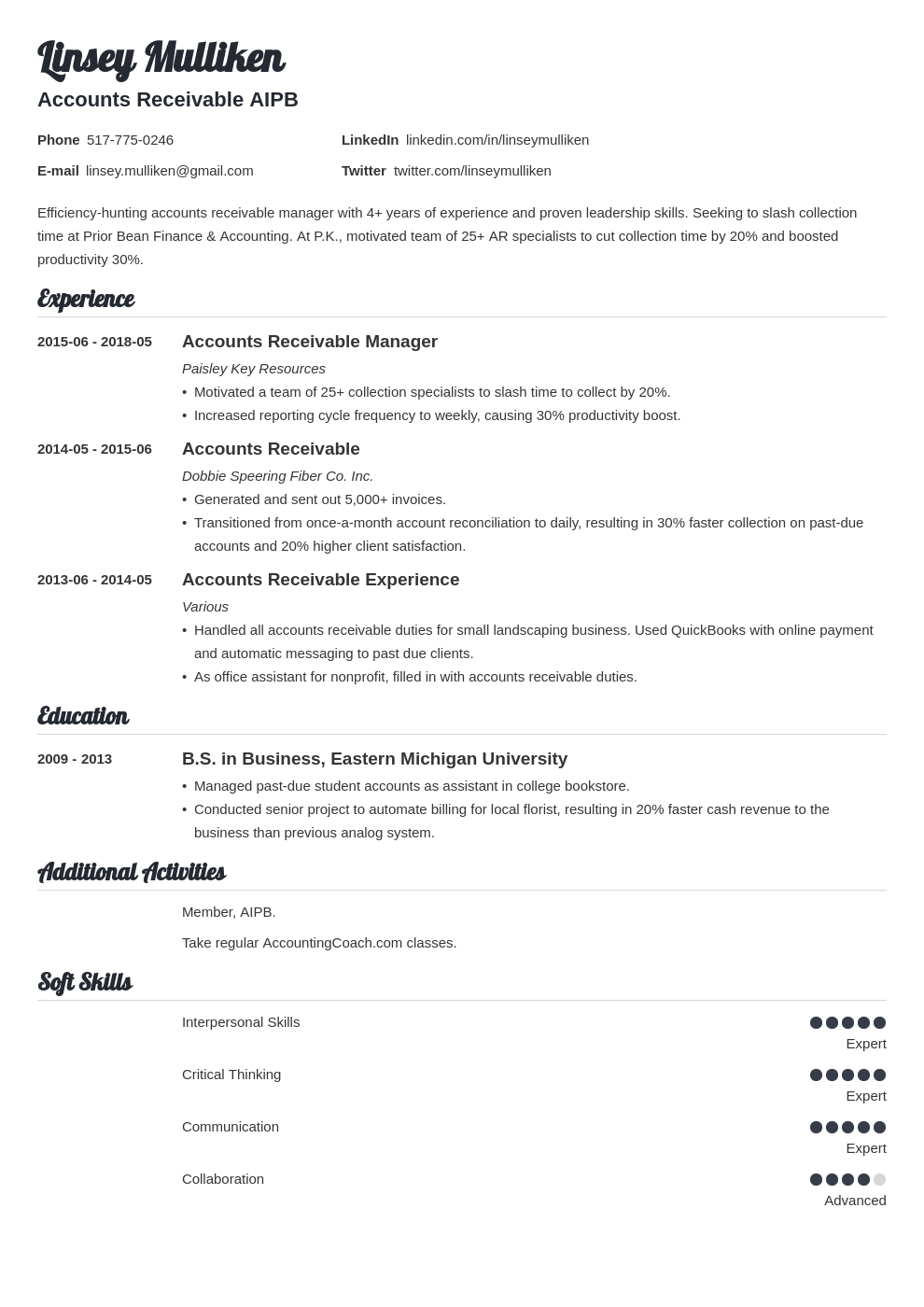

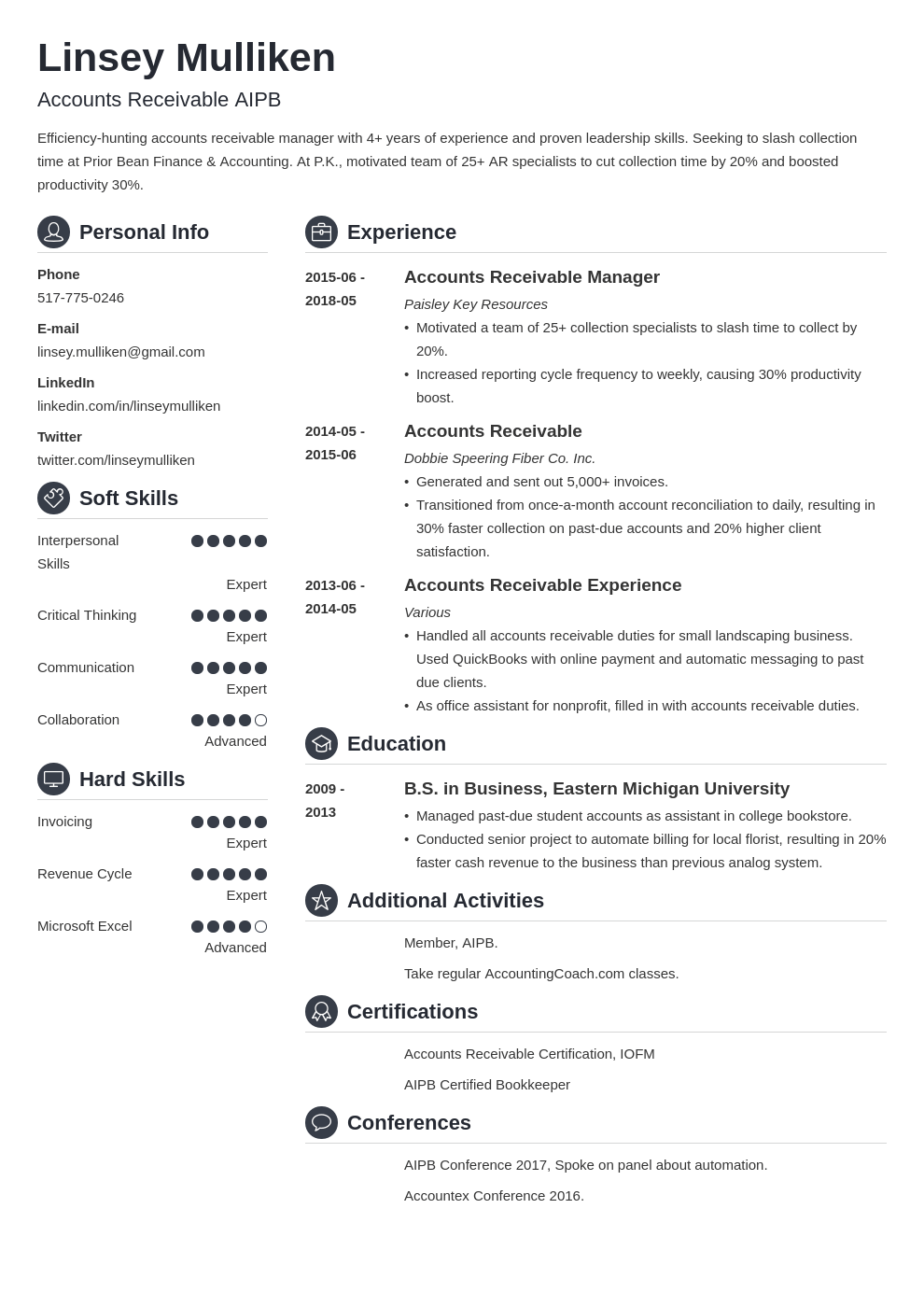

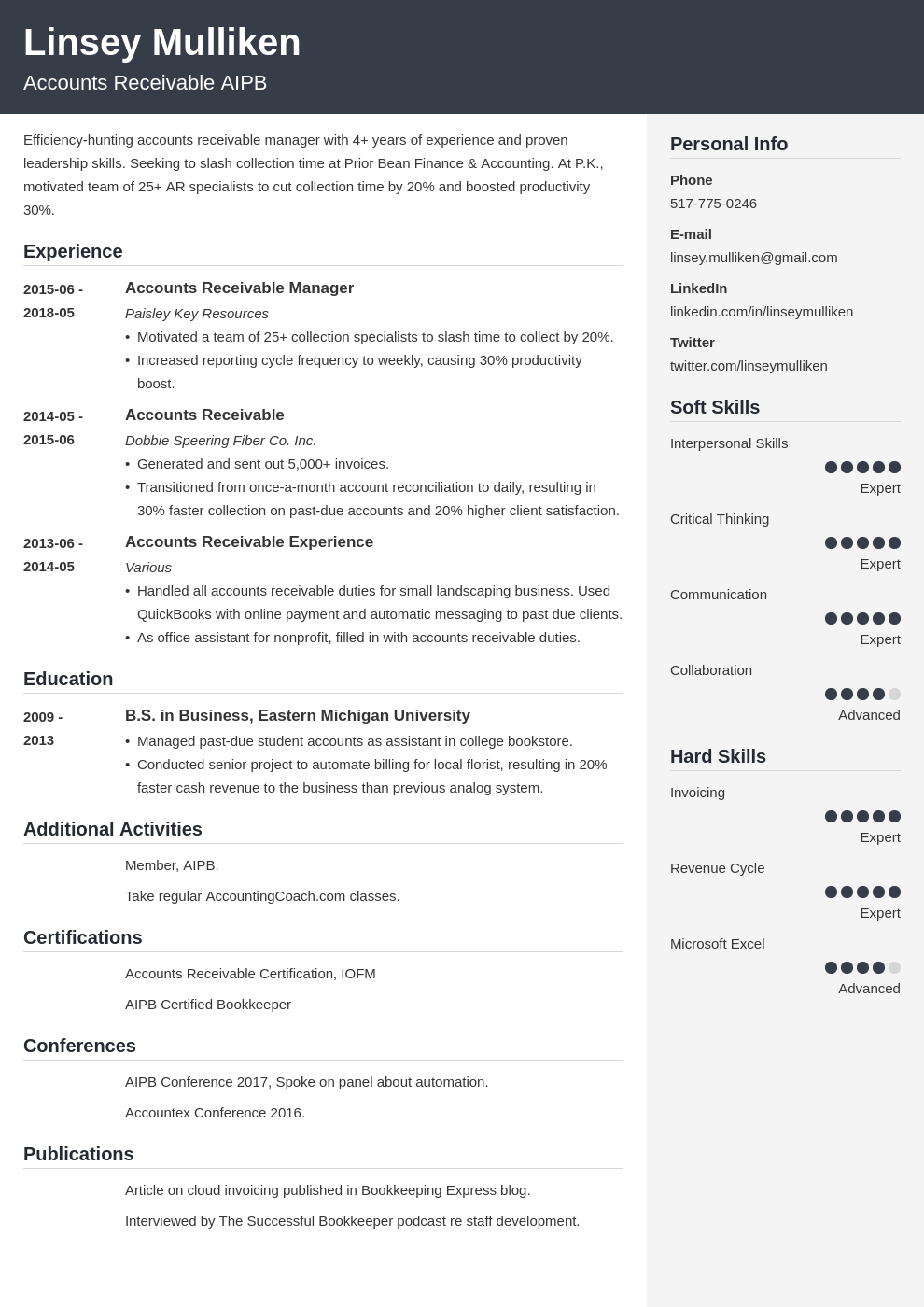

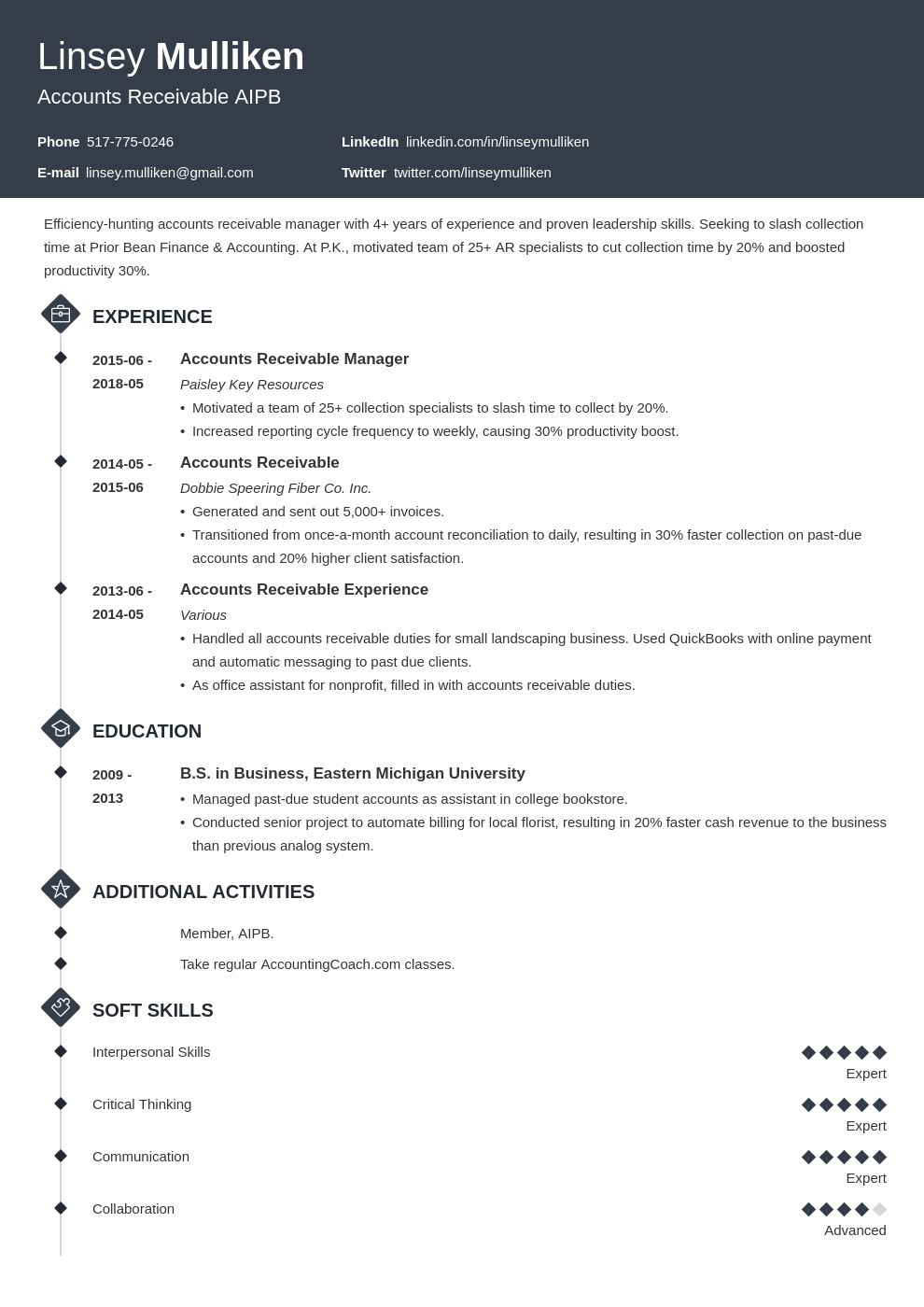

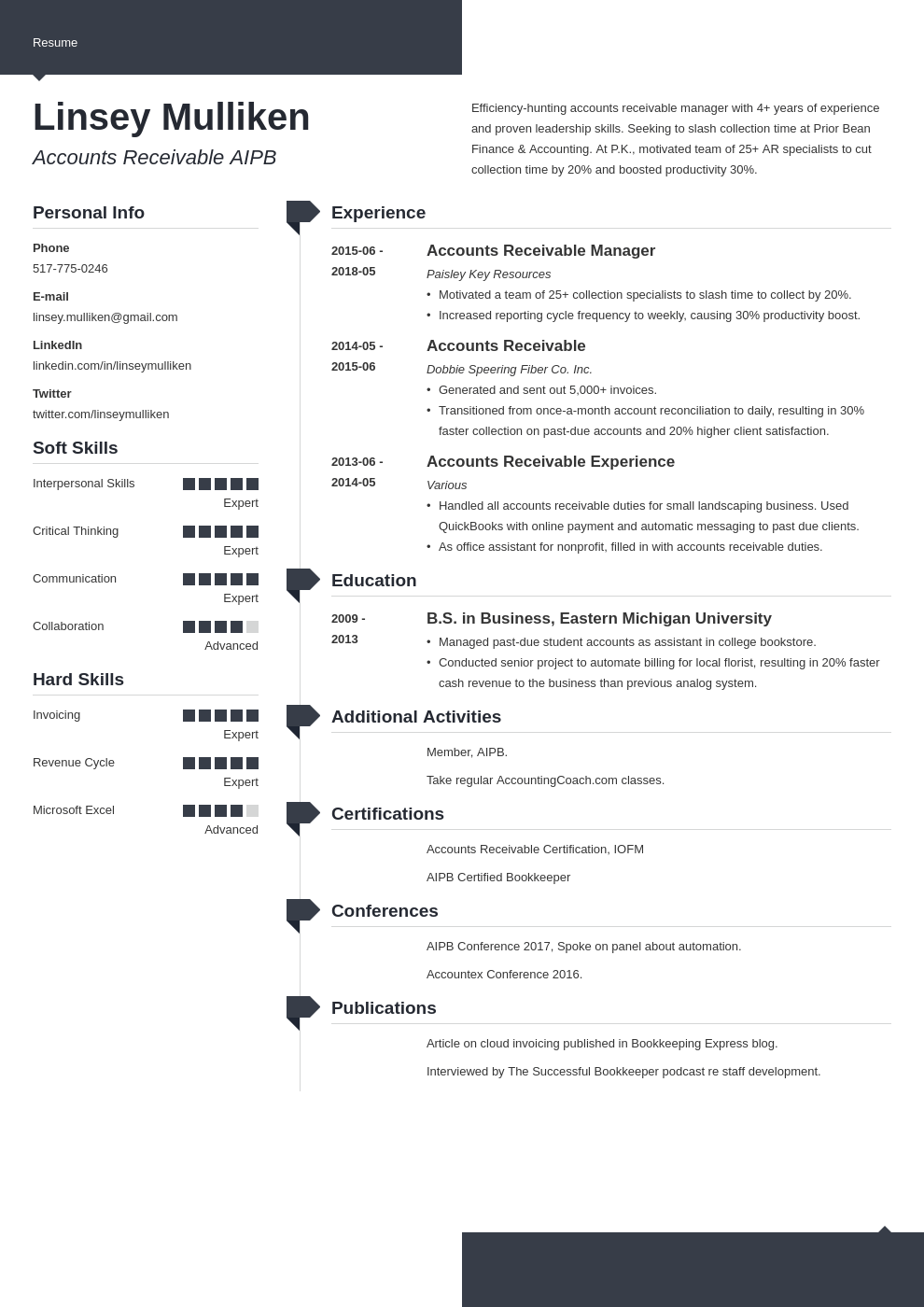

![Accounts Receivable Resume Samples [20+ AR Examples]](https://cdn-images.zety.com/pages/accounts_receivable_resume_example_3.jpg?fit=crop&h=650&q=75)

You’re chasing for payment and cashing it in. You’re screaming “show me the money!” as you effortlessly receive cash into the business.

But you don’t just want to be cashing in payments at work. You want to receive a decent paycheck yourself.

To do that you’ll need a first-class accounts receivable resume, just like the one below.

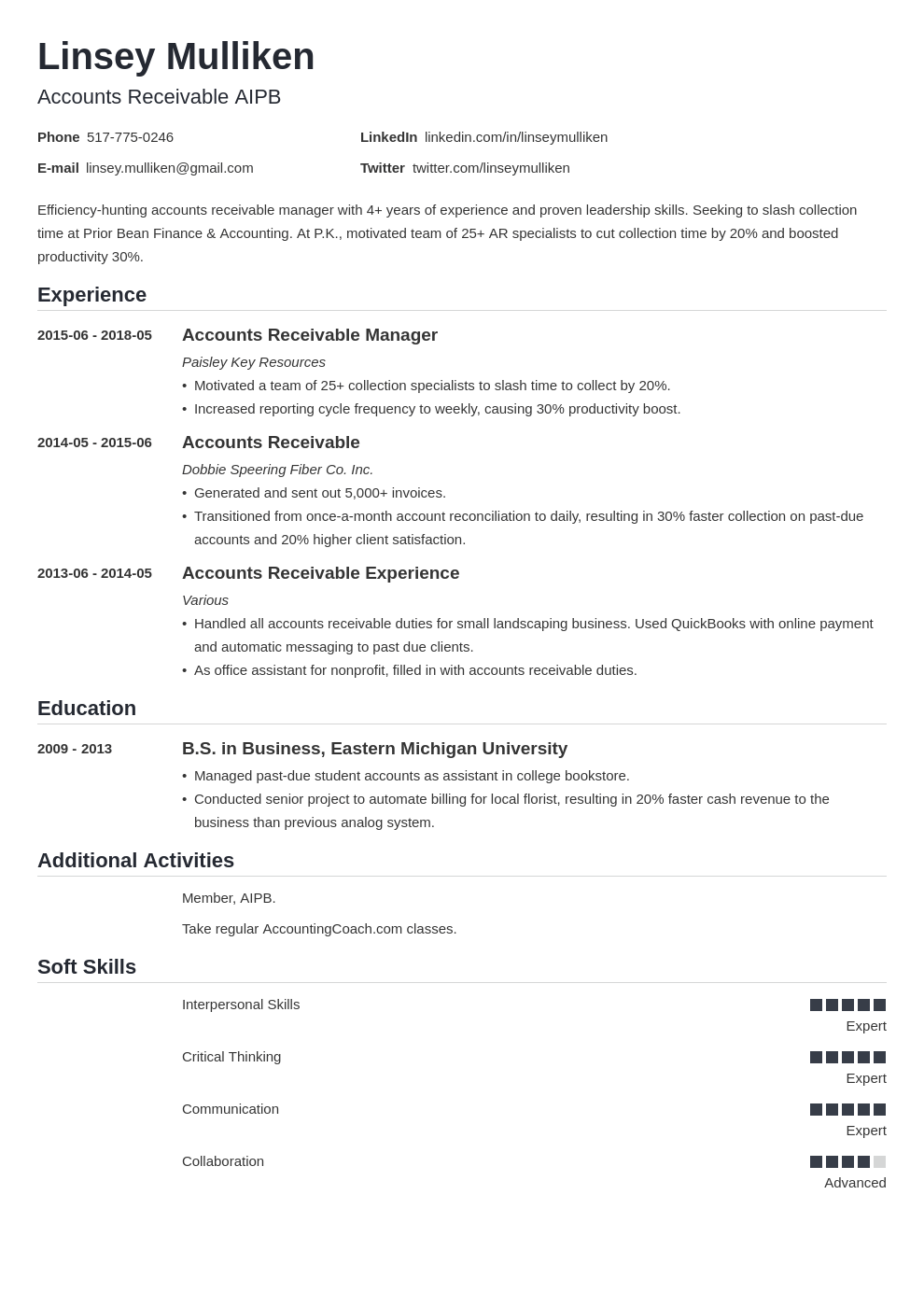

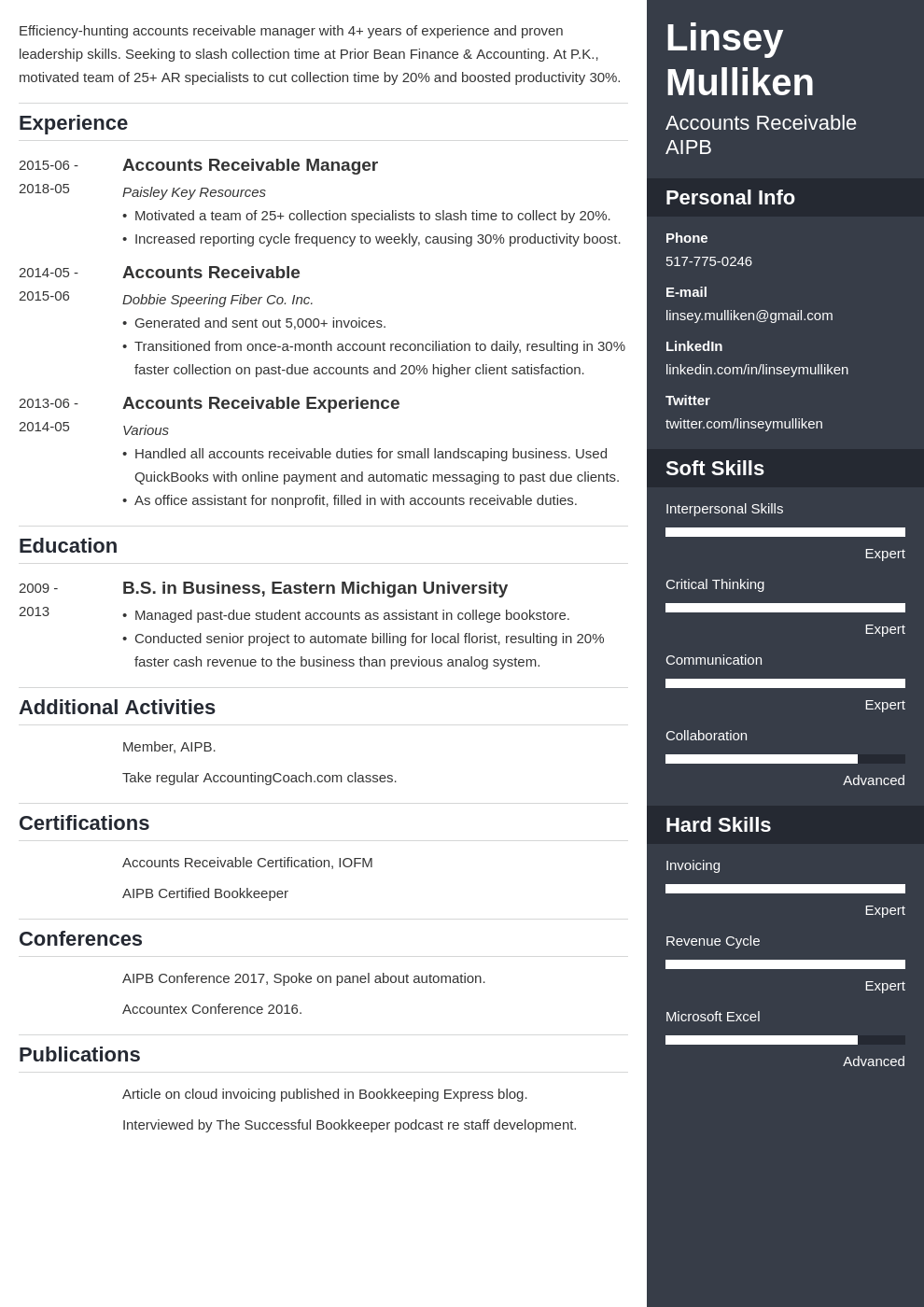

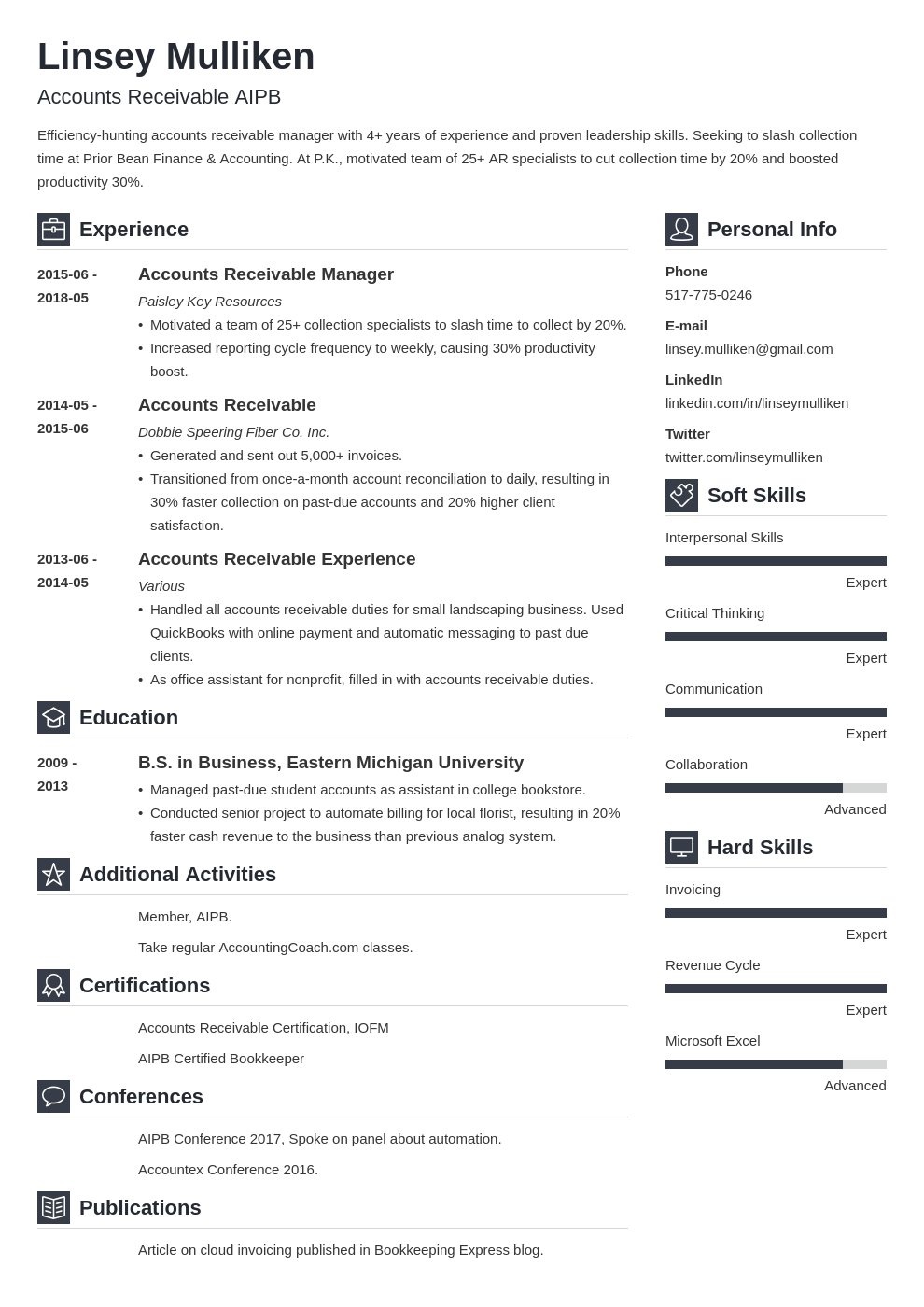

Want to save time and have your resume ready in 5 minutes? Try our resume builder. It’s fast and easy to use. Plus, you’ll get ready-made content to add with one click. See 20+ resume templates and create your resume here.

Sample resume made with our builder—See more resume samples here.

Considering similar jobs in your industry? See these related resume guides.

Penny Payments

601-4363-466

Professional Summary

Accounts Receivable Specialist with 5+ years of experience. Dedicated to creditor compliance, introducing invoice optimization and improvements to creditor contact protocols resulting in a 15% reduction in payment defaults equivalent to $75,000. Looking to take on new AR challenges and maximize payment received on terms at Lafayette Pharmaceuticals.

Work Experience

Isodyne Inc., Kansas City, MO

Accounts Receivable Specialist

January 2013–Present

Gallifrey Systems, Kansas City, MO

Accounts Receivable Clerk

February 2011–January 2013

Education

2011– 2014, BSBA in Accounting

University of Central Missouri, Warrensburg, MO 64093

Skills

Certifications

Volunteering

Now sit back and enjoy. This is a formula for a job-winning accounts receivable resume that’s more useful than VLOOKUP.

Accounts receivable specialists are responsible for receiving cash into a business. Your accounts receivable specialist resume needs to show you can do that by issuing invoices, dealing with invoicing related correspondence, answering clients’ billing queries, and initiating collections on accounts that are past due.

There’s a lot of work that goes into being a good AR professional.

But you’ve only got 7 seconds to grab a recruiter’s attention. To make the most of their eye time on your accounts receivable resume you need to follow these rules.

One more thing, how many pages for a resume? One page is always best but if you’ve got plenty of experience, then go ahead and stretch to two. No more.

Your resume summary or resume objective are two different types of resume profile.

A professional summary sits at the top of your resume and forms a short 3–4 sentence paragraph that advertises you as the best candidate for the job. It’s what your colleagues in sales would call an elevator pitch.

Got two or more years experience? Then use an accounts receivable resume career summary.

Just finished education or switching careers to the world of balance sheets and payment terms? Then a career objective is the profile for you.

Next, let’s check the balance sheet on your work experience section.

When making a resume in our builder, drag & drop bullet points, skills, and auto-fill the boring stuff. Spell check? Check. Start building a professional resume template here for free.

When you’re done, Zety’s resume builder will score your resume and tell you exactly how to make it better.

Your resume experience section has to collect payment pronto.

What if you’re writing an entry-level resume with no experience? No problem. Use the experience you do have and make it relevant to what you’re applying to.

Summer work, volunteering, bookkeeping for friends and family. That’s all real experience you can leverage for an entry-level accounts receivable clerk resume.

Pro Tip: Can’t come up with relevant experience? Go get some. Try out freelancing sites like Upwork and Fiverr and offer your skills. There’s plenty of demand for bookkeeping and accounts work.

Working in AR demands a good head for numbers, analytical skills, the ability to accurately follow set processes, plus knowledge of financial and tax regulations. To make the most of those skills you need a formal education so here’s how to make yours shine.

How about putting your GPA on your resume? That’s essential right? Not exactly. Only include it if it’s 3.5 or higher and you graduated less than 2–3 years ago.

Read more: High School on a Resume and Degree on a Resume

Your accounts receivable resume is shaping up nicely. Let’s add some skills.

No, not your photographic memory for the bios of minor Star Wars characters. I mean relevant accounts receivable skills for your resume.

Here’s how you credit the ledger for your skills section.

Pro Tip: Accounting software skills are a guaranteed win for your accounts receivable resume. If you’re new to the job, no problem. Power up your skills section with some online training. Check out Udemy and Coursera for a start.

Read more: Soft Skills for a Resume and Hard Skills for a Resume

Plus, a great cover letter that matches your resume will give you an advantage over other candidates. You can write it in our cover letter builder here. Here's what it may look like:

See more cover letter templates and start writing.

We’re not done yet. You could say the debtor has promised payment, but it still hasn’t hit our bank account. Let’s finalize that incoming with some extra resume sections.

It’s simple, just include additional sections that make you an even more attractive candidate.

Just how important is a cover letter these days anyway? Let’s just say reports of its death have been greatly exaggerated.

Almost half of recruiters will reject your application if you don’t include a cover letter for a job. You wouldn’t willingly halve your chances of success would you?

That said, don’t just throw a cover letter together and cross your fingers. Do it right like this.

Lastly, don’t just send your application and wait for the phone to ring. Send a follow-up email after your job application to boost your chances of success.

And that’s it, payment received in full—

Your complete formula for a flawless accounts receivable resume.

Plus, a great cover letter that matches your resume will give you an advantage over other candidates. You can write it in our cover letter builder here. Here's what it may look like:

See more cover letter templates and start writing.

Did we miss anything? Have you got advice on writing a great accounts receivable resume? Ask away in the comments section and thanks for reading.

You’re Speed-Typist of the Year ready to take on large volumes of data with 100% accuracy. And your cover letter will prove this to your next employer.

Boost your chances of getting an accounts payable job and write a reconciled cover letter for your accounts payable resume.

Addressing salary expectations in a cover letter is tough. Get it right and maximize your earning potential with these examples and tips.