Financial Analyst Resume Examples (Guide & Templates)

A step by step guide to writing a professional resume for financial analyst. Use our financial analyst resume sample and a template.

As a bank teller, you’re the face of the branch.

You’ll handle thousands of dollars, hundreds of customers, and dozens of problems each day.

To get the bank teller job, you need to show the branch manager you can stay calm even when you hear a customer say “this is a stick up.”

It’s not as hard as you might imagine.

Read on to see a professional bank teller resume example you can adjust and make yours. Plus, you’ll learn an easy formula for writing a resume for bank teller jobs that will land you 10x more bank interviews than any other resume you’ve written in the past.

Want to save time and have your resume ready in 5 minutes? Try our resume builder. It’s fast and easy to use. Plus, you’ll get ready-made content to add with one click. See 20+ resume templates and create your resume here.

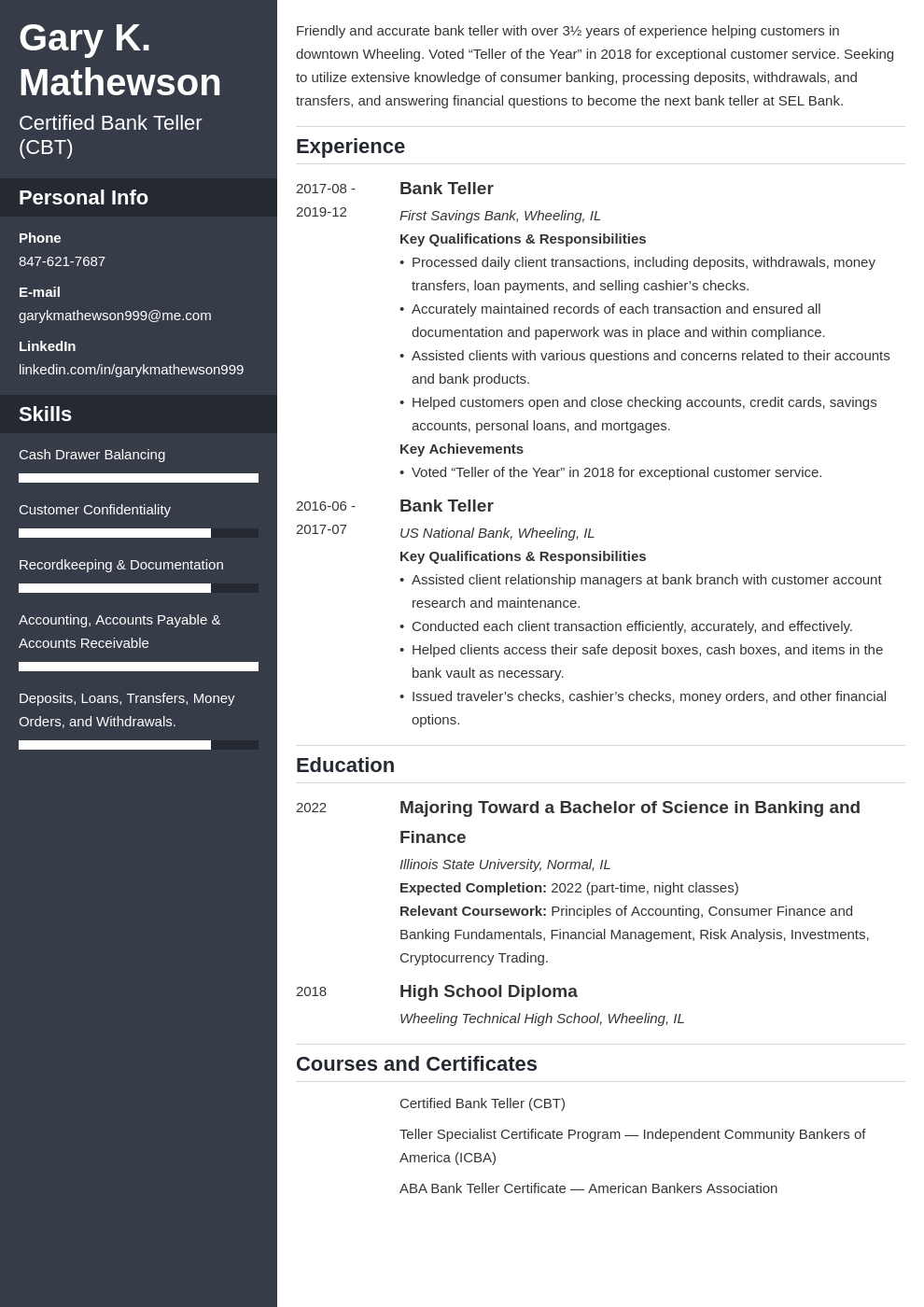

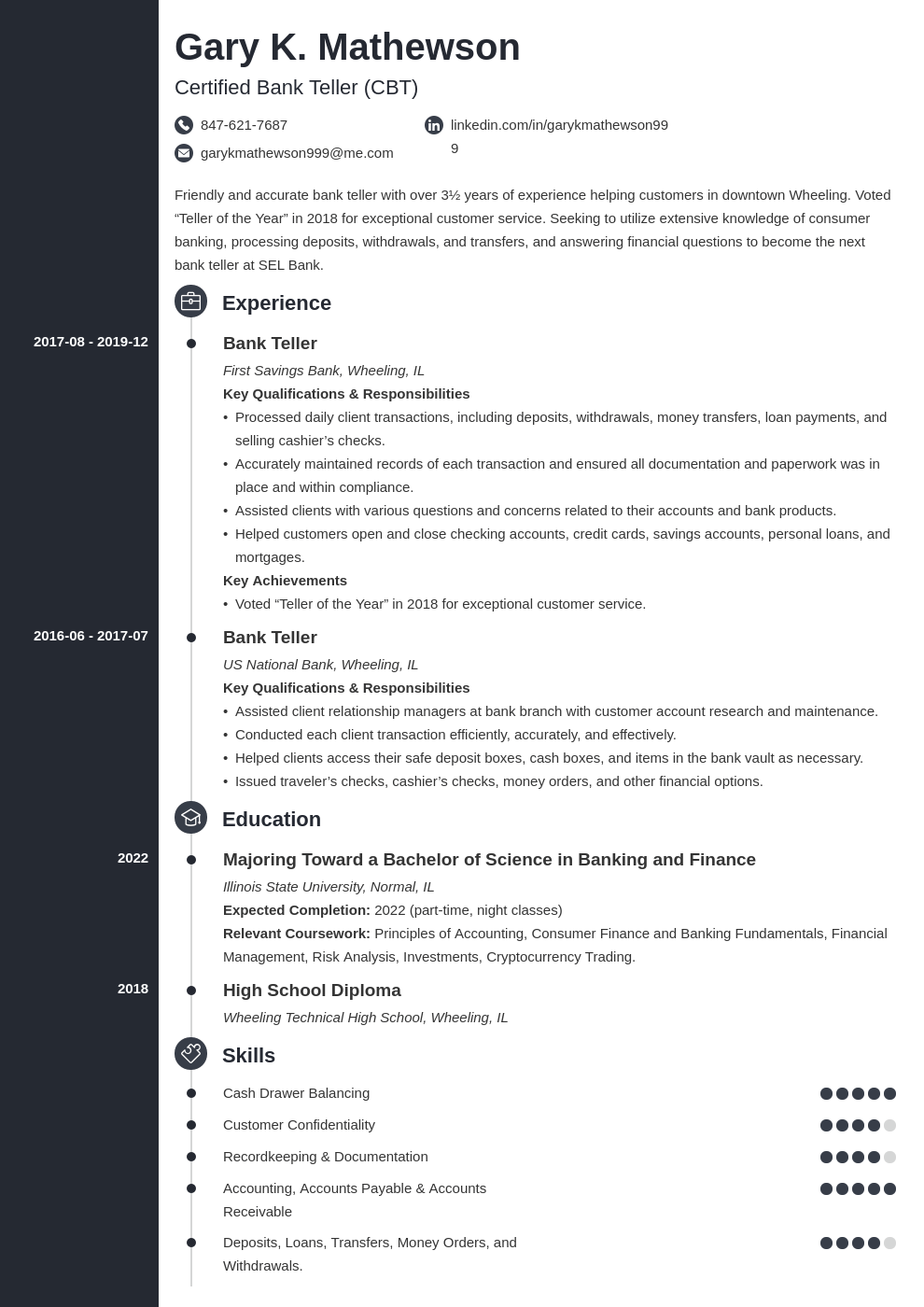

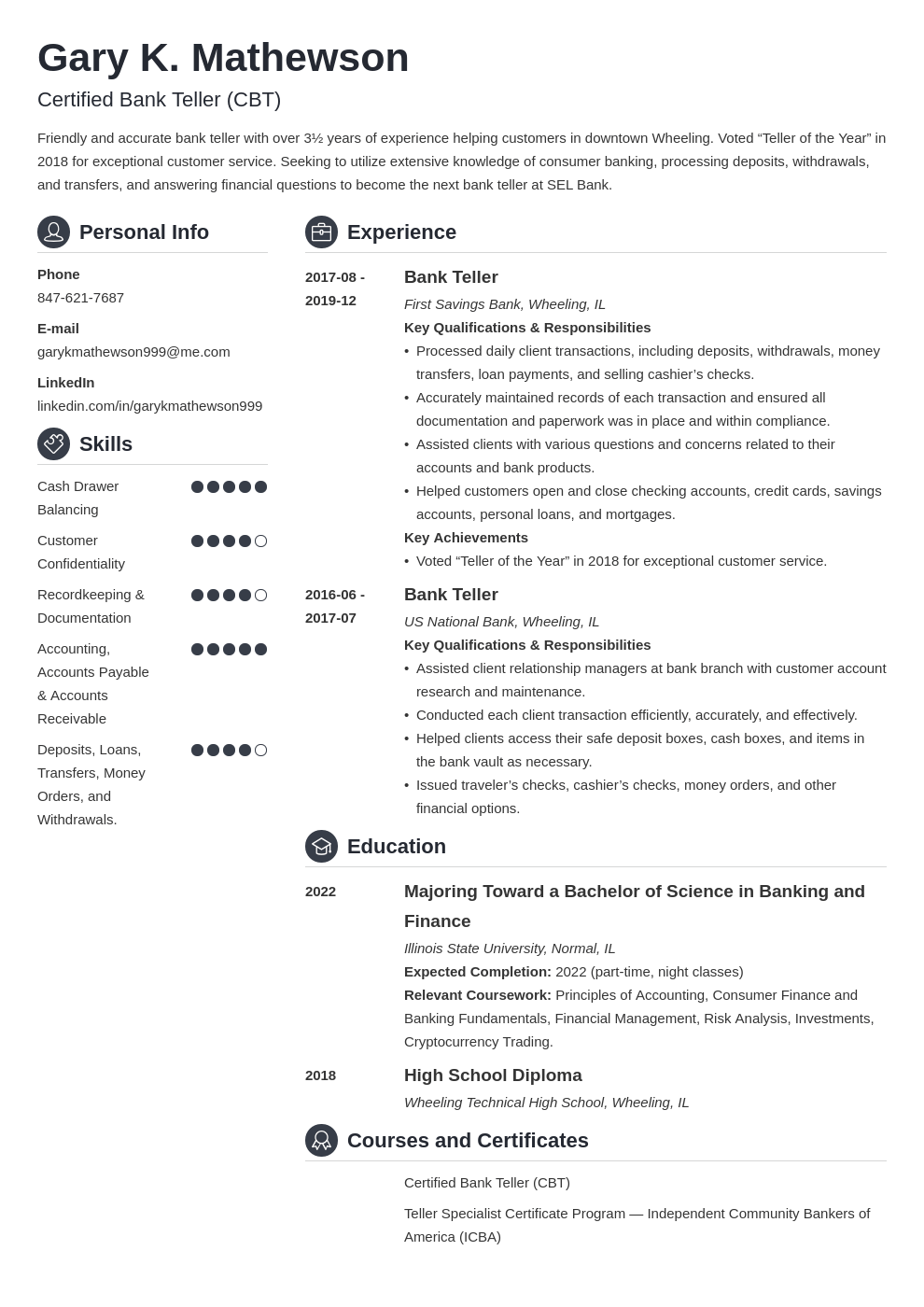

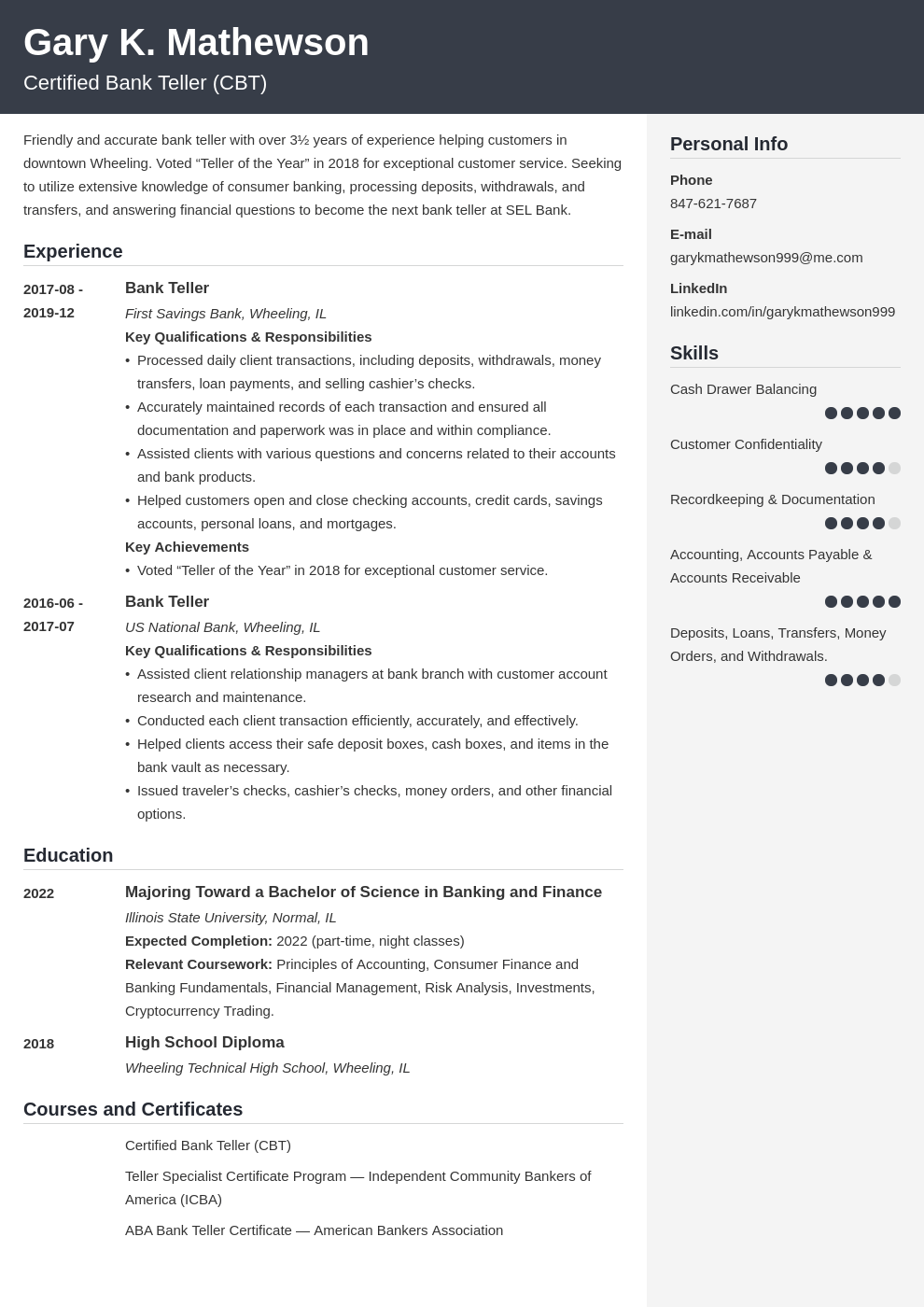

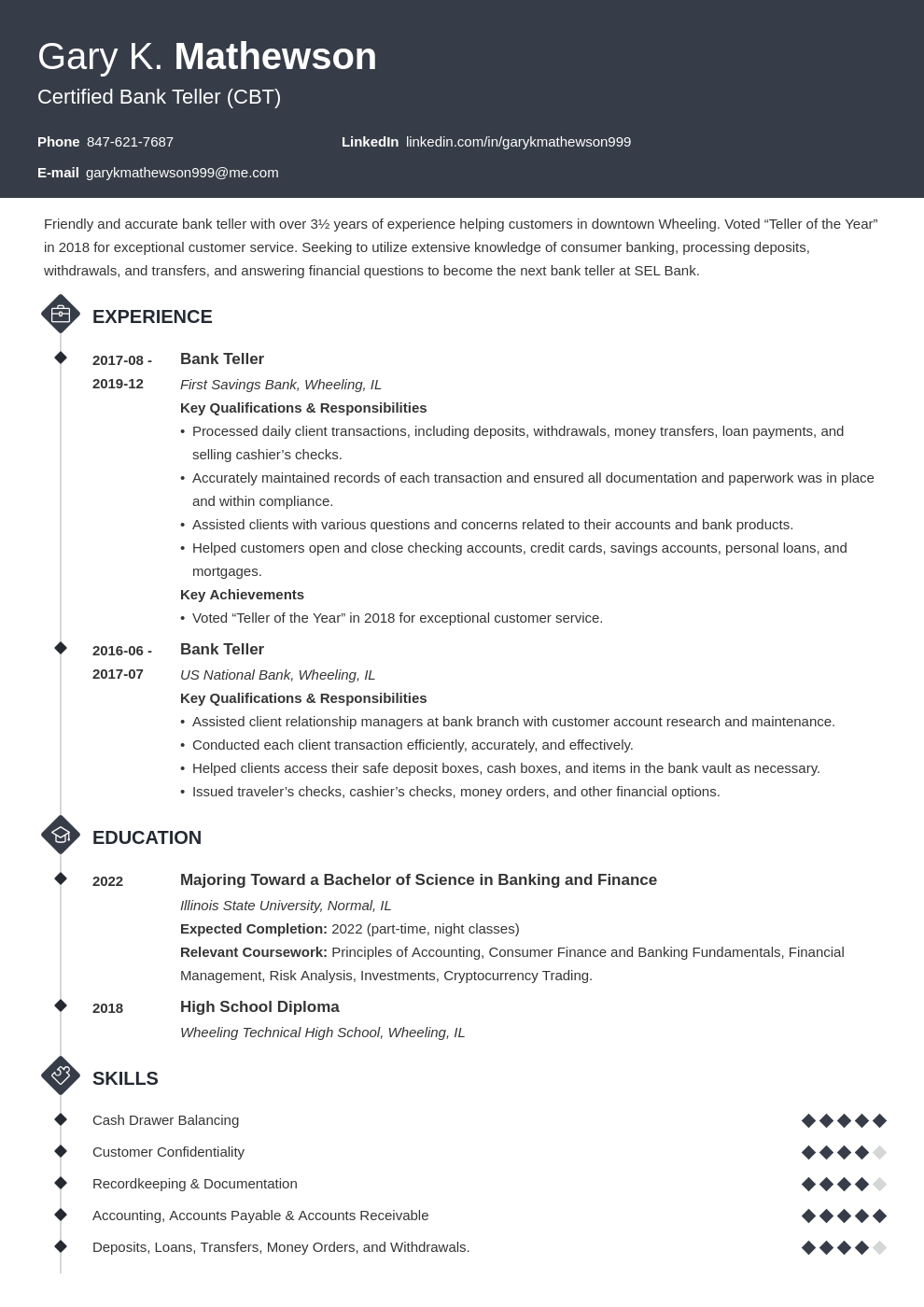

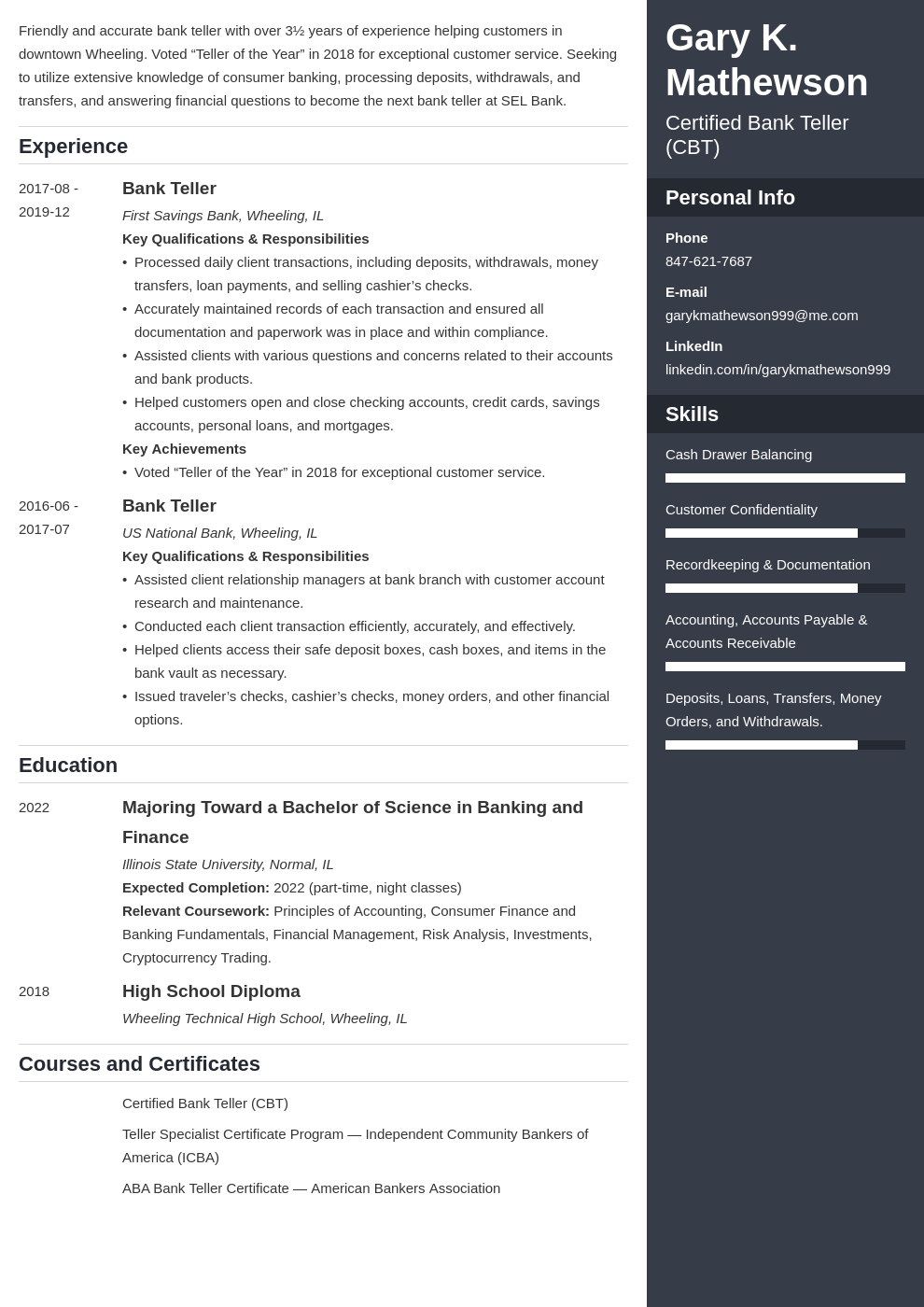

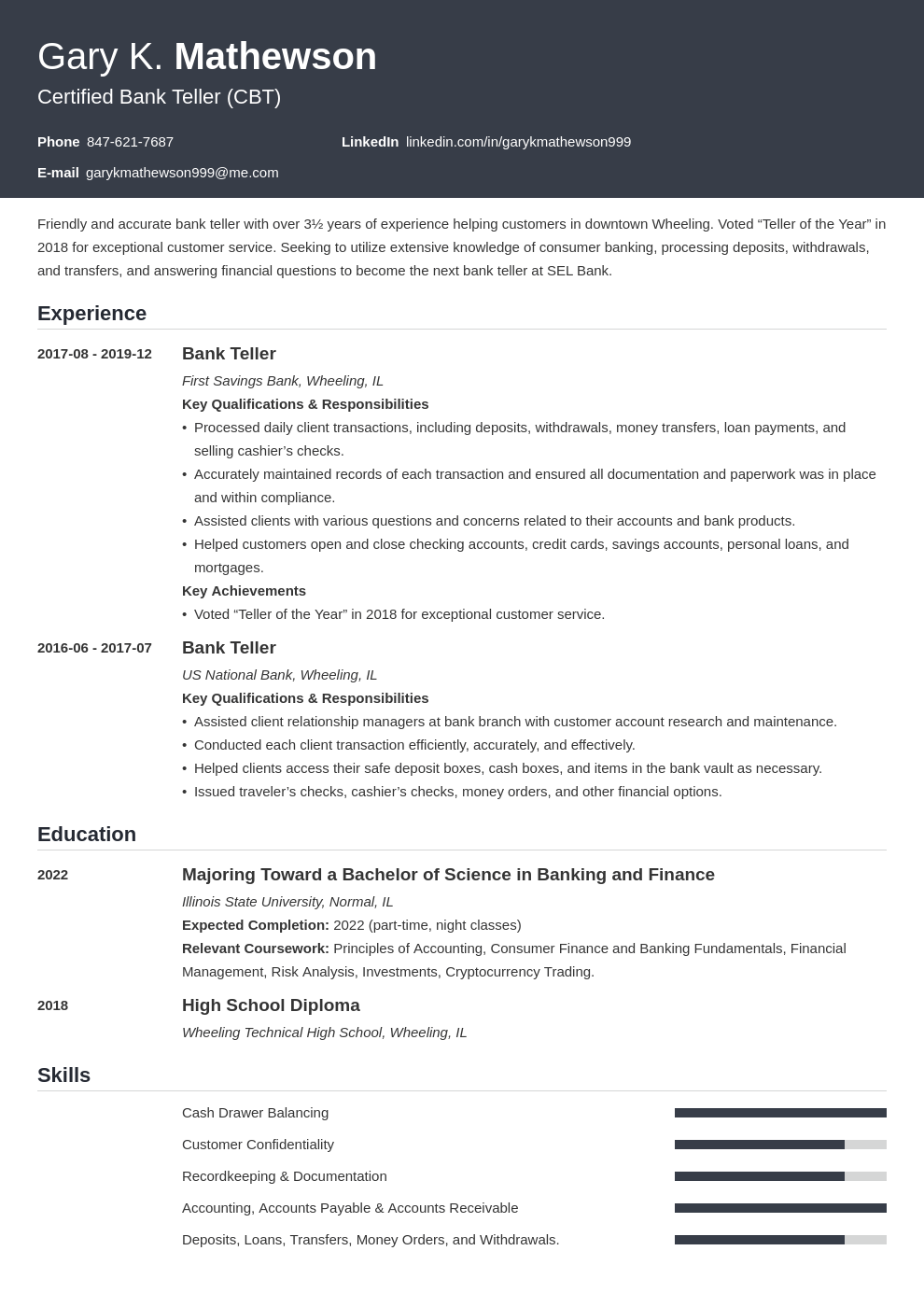

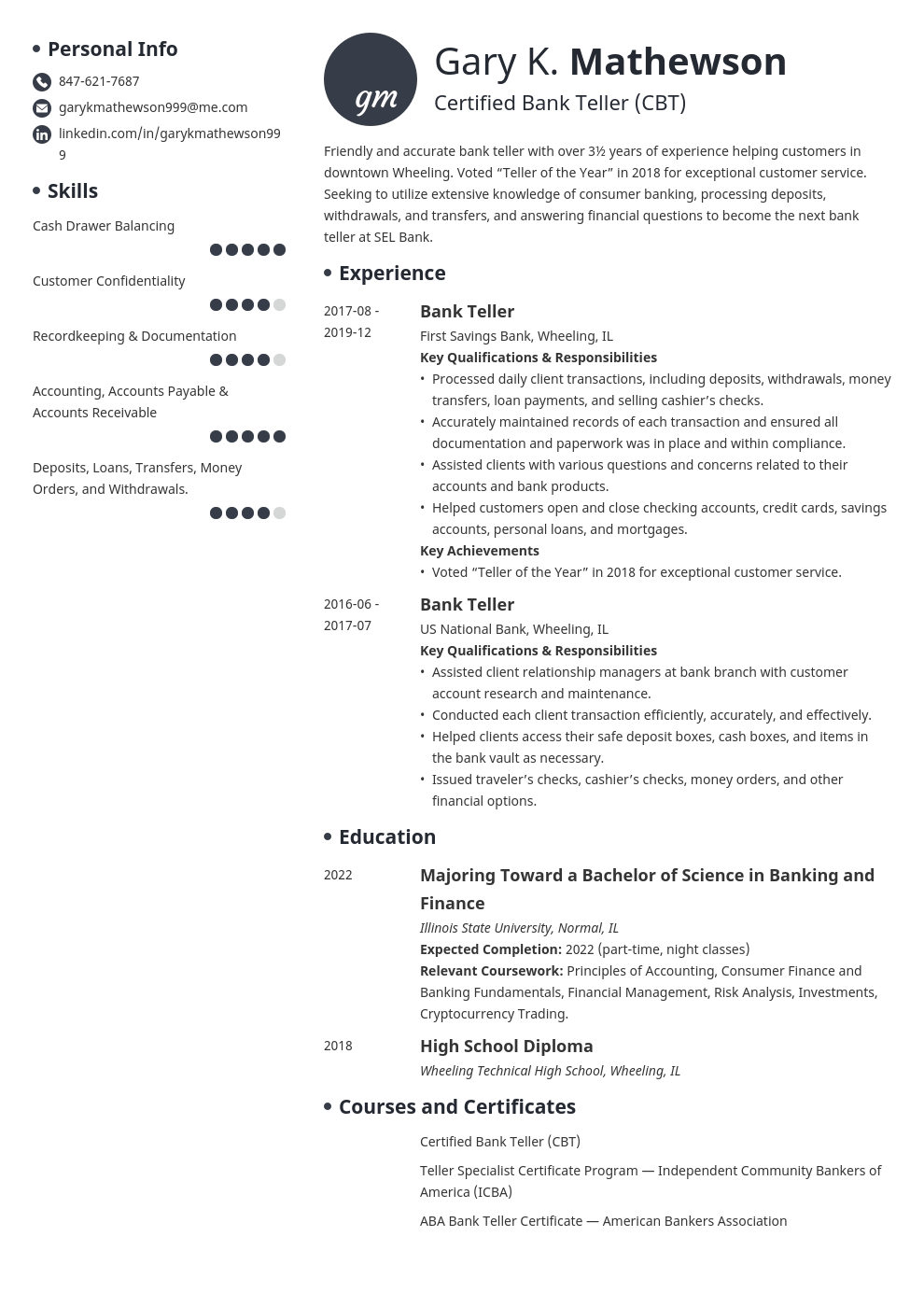

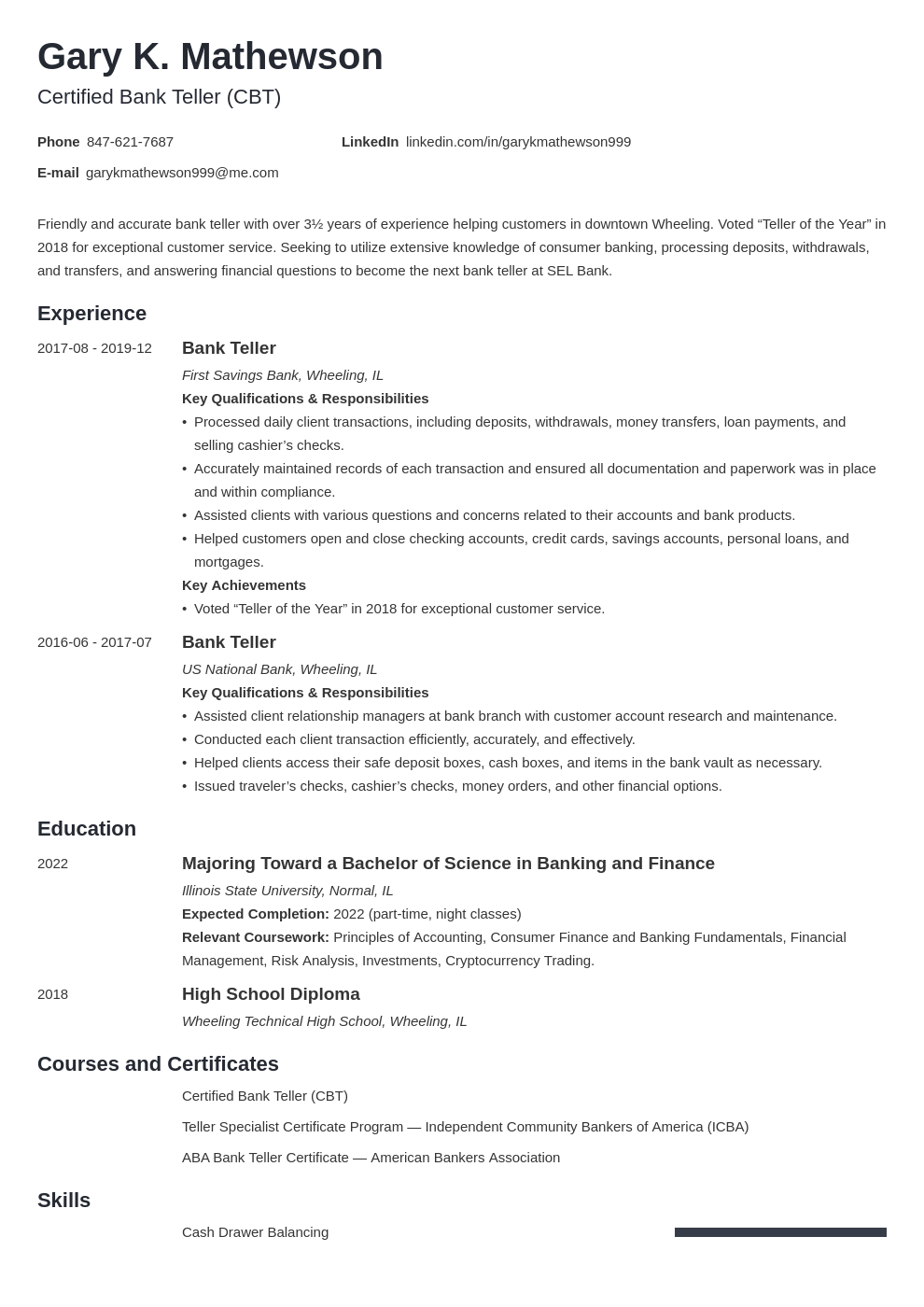

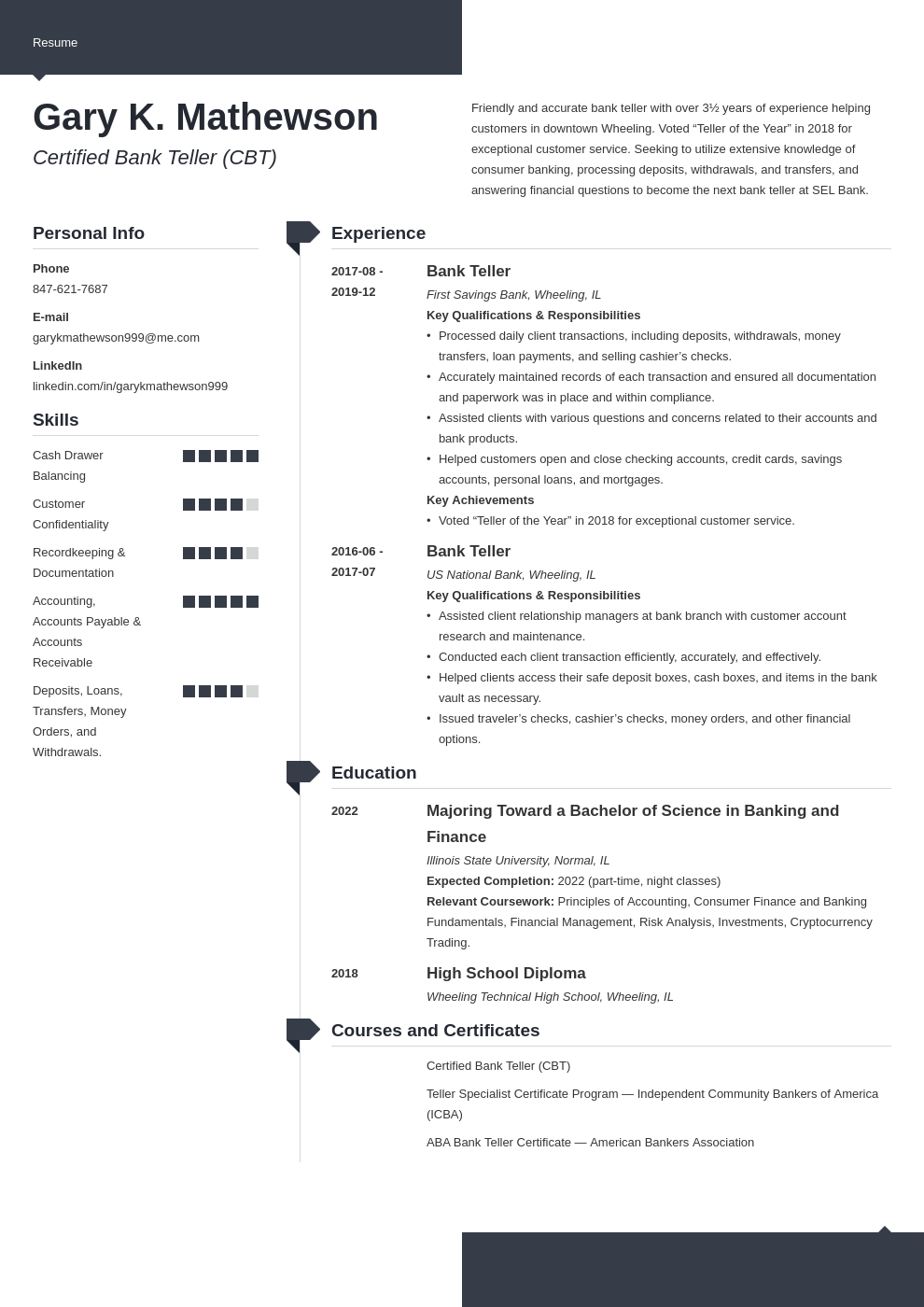

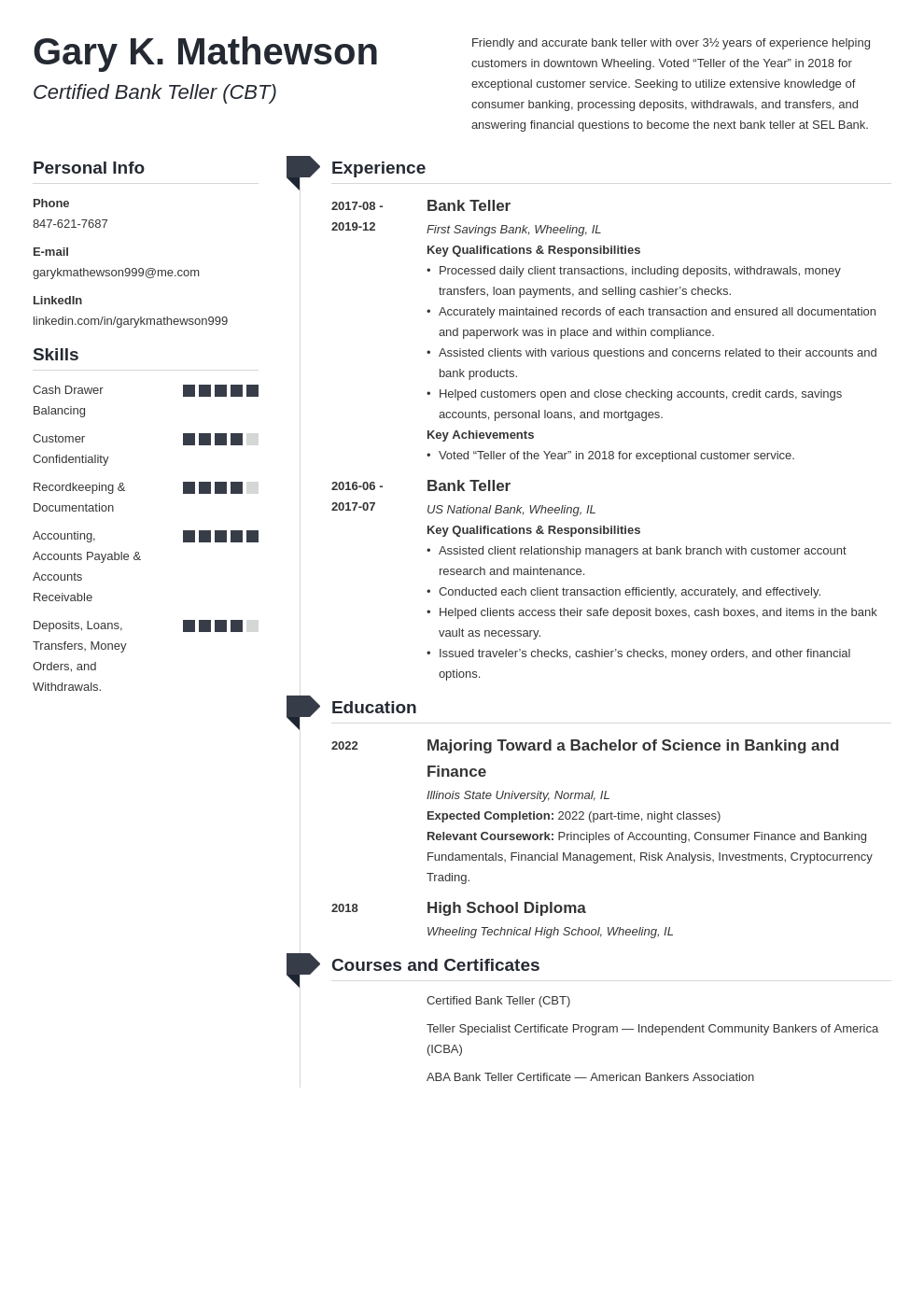

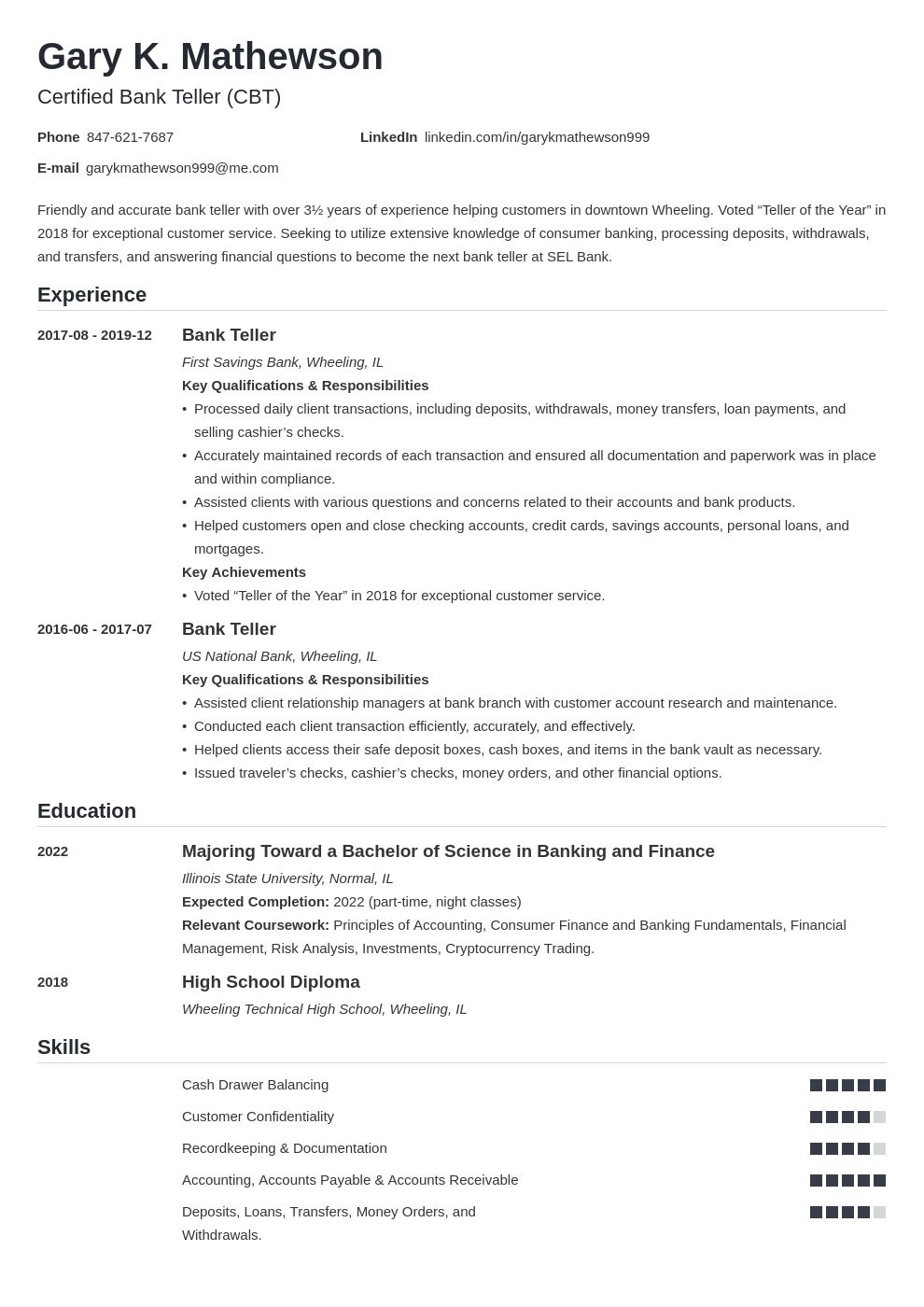

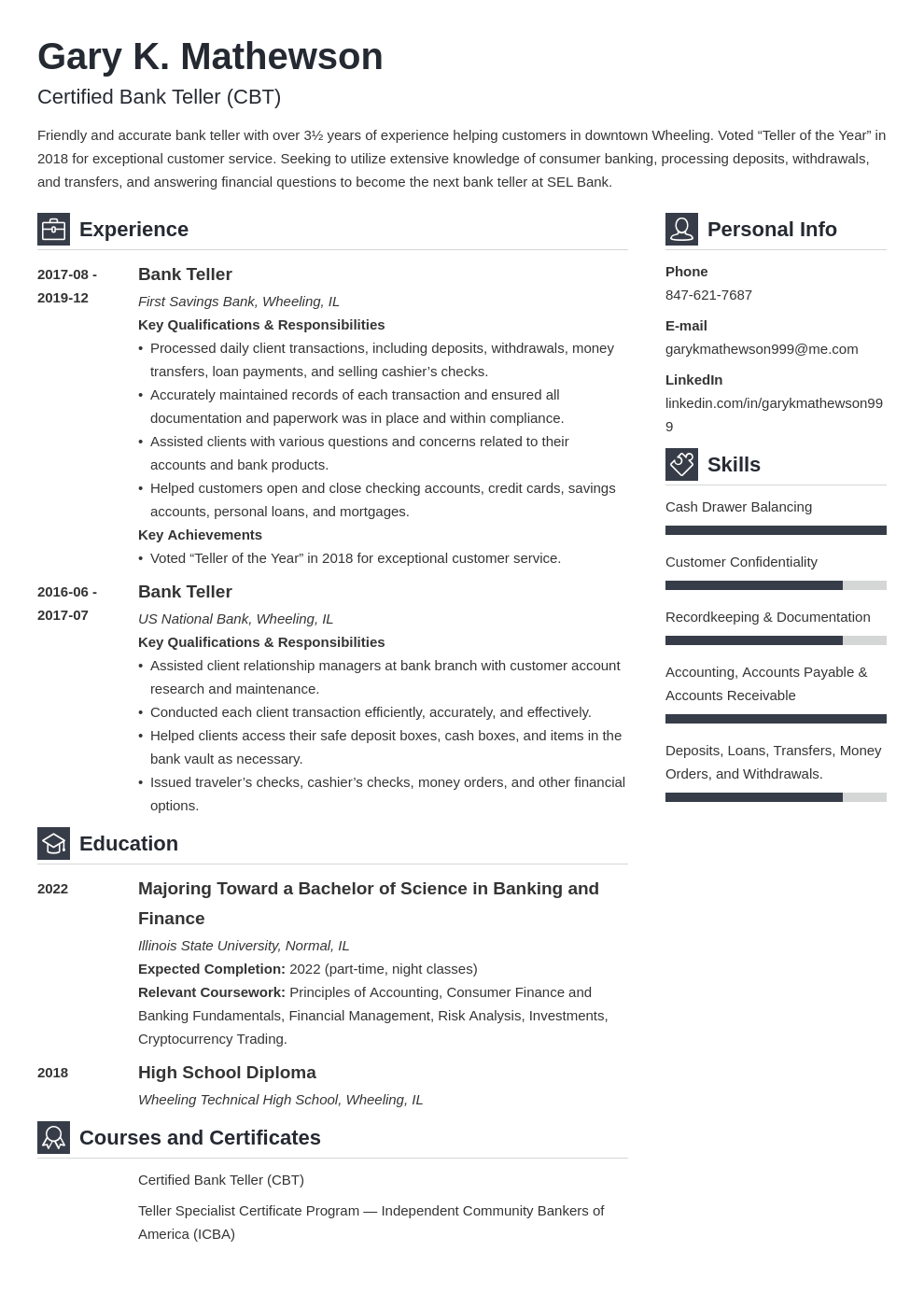

Sample bank teller resume —See more resume examples here.

We’re about to begin, but first, here are some other bank-related resume examples:

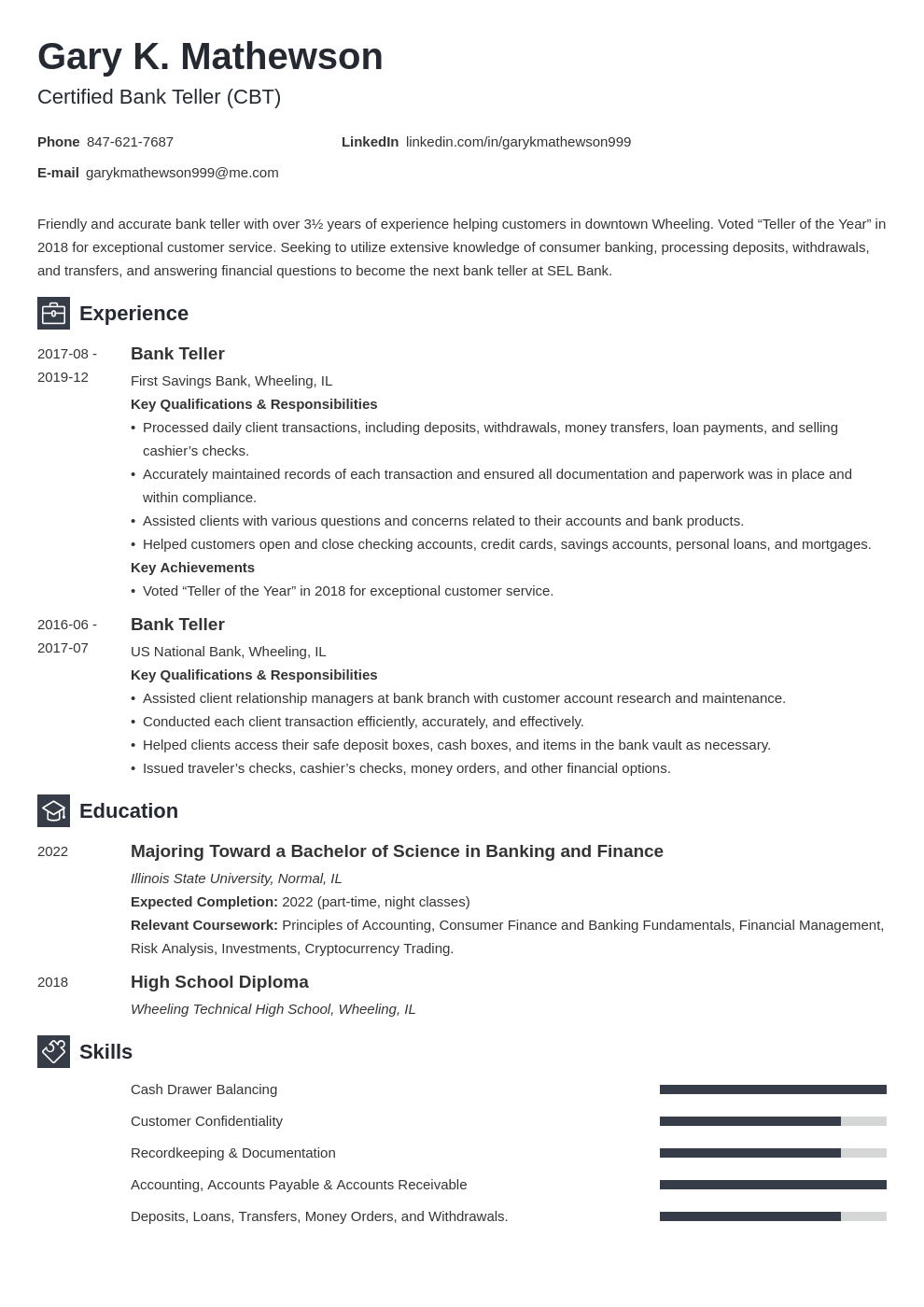

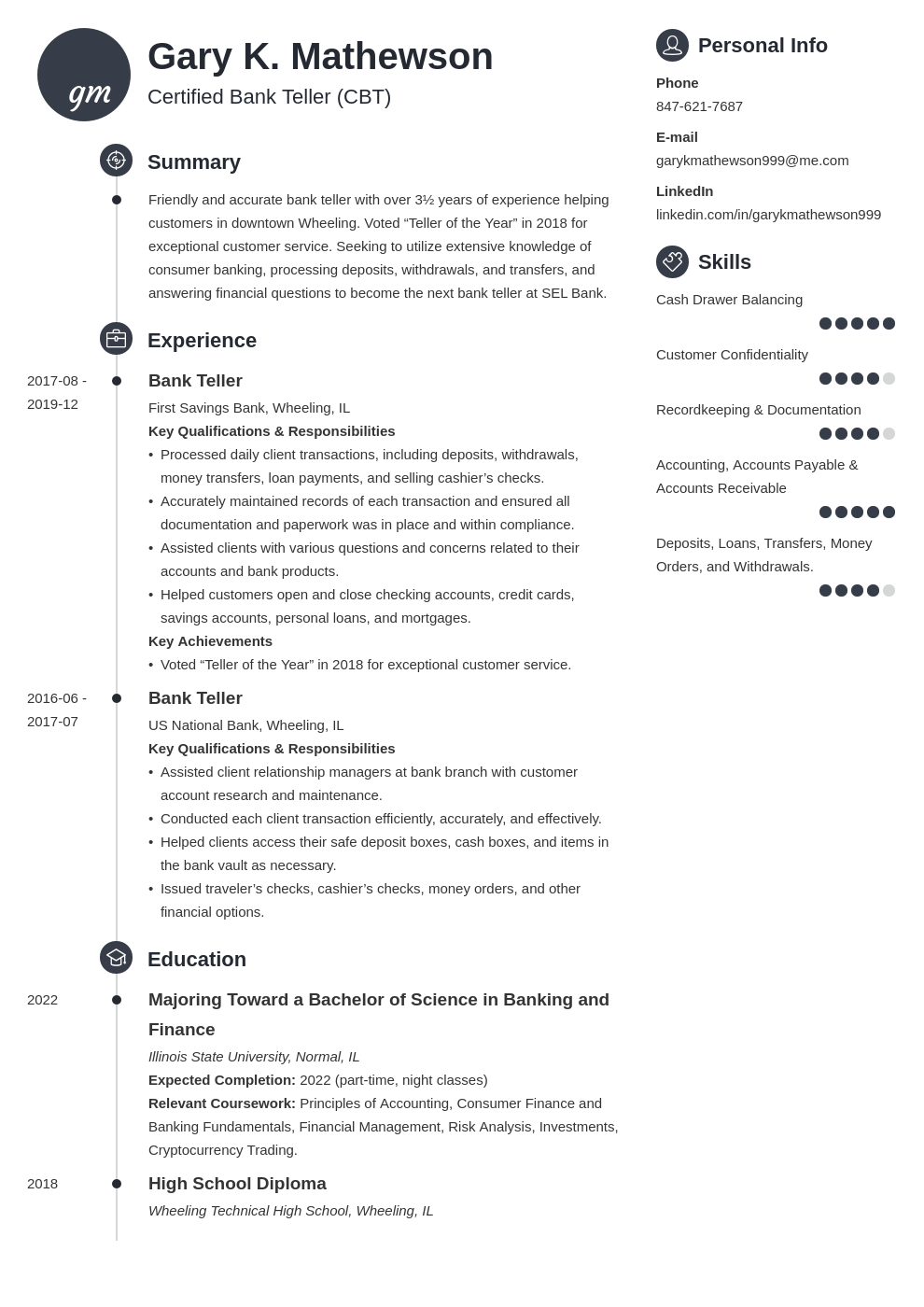

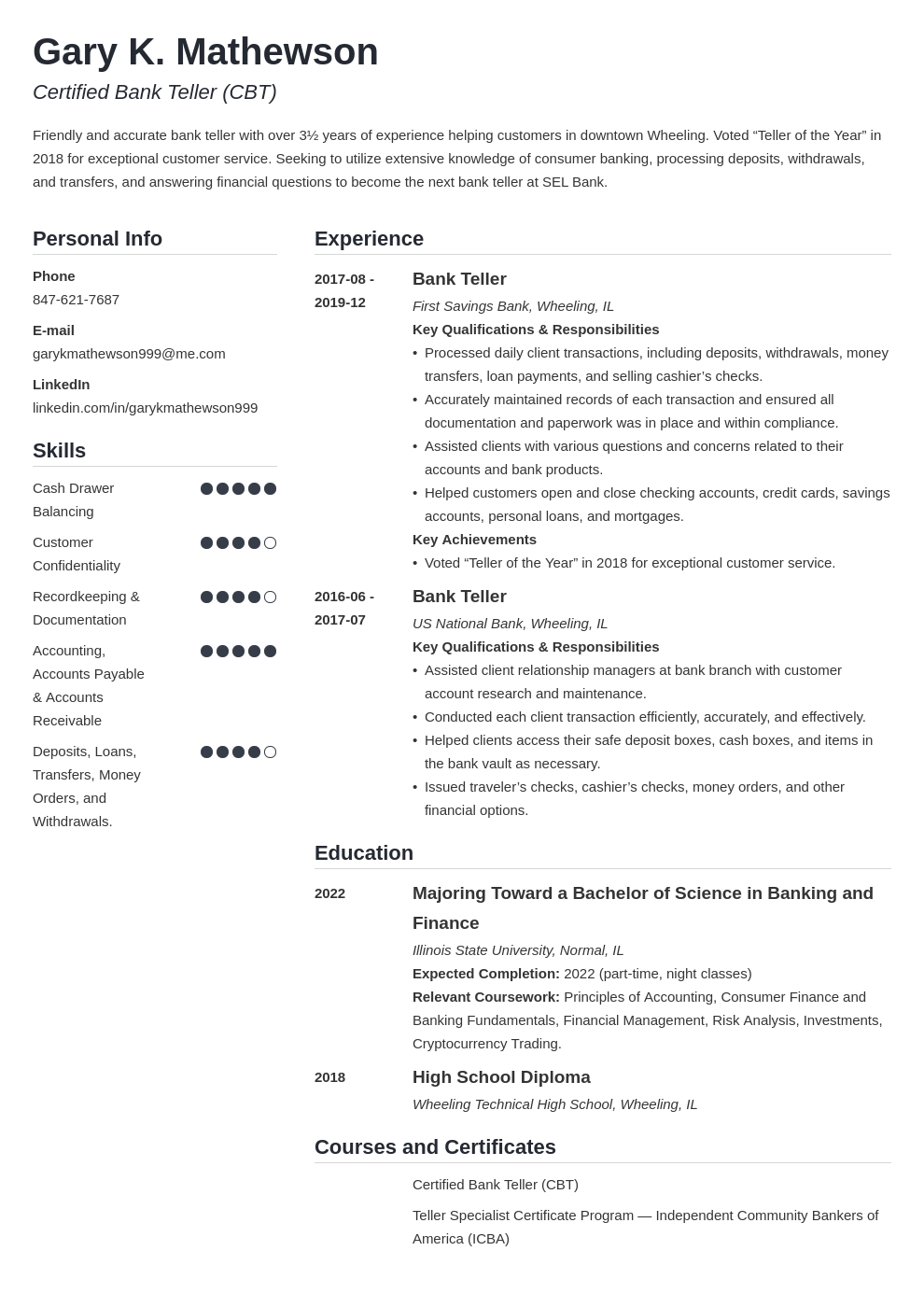

Gary K. Mathewson

Certified Bank Teller (CBT)

847-621-7687

linkedin.com/in/garykmathewson999

Summary

Friendly and accurate bank teller with over 3½ years of experience helping customers in downtown Wheeling. Voted “Teller of the Year” in 2018 for exceptional customer service. Seeking to utilize extensive knowledge of consumer banking, processing deposits, withdrawals, and transfers, and answering financial questions to become the next bank teller at SEL Bank.

Experience

Bank Teller

First Savings Bank, Wheeling, IL

August 2017–December 2019

Key Qualifications & Responsibilities

Key Achievements

Bank Teller

US National Bank, Wheeling, IL

June 2016–July 2017

Key Qualifications & Responsibilities

Education

Majoring Toward a Bachelor of Science in Banking and Finance

Illinois State University, Normal, IL

Expected Completion: 2022 (part-time, night classes)

Relevant Coursework: Principles of Accounting, Consumer Finance and Banking Fundamentals, Financial Management, Risk Analysis, Investments, Cryptocurrency Trading.

High School Diploma

Wheeling Technical High School, Wheeling, IL

Graduation: 2018

Skills

Courses and Certificates

Now, here’s our carefully calculated formula for a perfect bank teller resume:

1

Want to make sure your value as a bank teller candidate achieves accelerated appreciation?

Then—

Format your resume for bank teller jobs just right.

Here’s how to format any kind of banking resume:

This is what we recommend a resume for bank tellers include:

Learn more about formatting a resume: How to Choose the Best Resume Format

One last trick that earns interest—

Save the bank resume intro paragraph for last. That’s right, even though it comes first, writing it at the end lets you avoid writer’s block and add the perfect details to wow them.

2

Here’s some scary news:

Bank teller jobs, between 2018 and 2028, will decline by 12% in the United States itself.

This comes out to 57,800 less jobs a decade from now, and more competition for the remaining bank jobs.

So—

Show the bank your creditworthiness is high while the rest of the applicants are a credit risk by making a top-notch work experience section.

Here’s what you need to add to your bank teller description of past experience:

Now—

Here are two experienced bank teller job description for resume examples for reference:

| Right |

|---|

Bank Teller Key Qualifications & Responsibilities

Key Achievements

|

| wrong |

|---|

Bank Teller Key Qualifications & Responsibilities

|

Above, the second example is just not detailed enough. If you don’t bother with the details, they won’t bother calling you in for a bank interview.

The first one, though, pays dividends. It’s detailed, tailored to the specific bank job description, and it includes a numbered accomplishment for the gold.

What if you’re writing an entry-level bank teller resume?

No problem. You just need to show the most bank-related job responsibilities in your work history section.

Here are two bank teller resume no experience examples to consider:

| Right |

|---|

Salesfloor Associate Key Qualifications & Responsibilities

Key Achievements

|

| Wrong |

|---|

Salesfloor Associate Key Qualifications & Responsibilities

|

See, even if you weren’t a bank teller in the past, you can still add banking-relevant job duties in your bank teller work history section.

When making a resume in our builder, drag & drop bullet points, skills, and auto-fill the boring stuff. Spell check? Check. Start building a professional resume template here for free.

When you’re done, Zety’s resume builder will score your resume and tell you exactly how to make it better.

For more on a work experience section for a resume: Here's How to Create a Job-Winning Past Employment Resume Section

3

A high school diploma or GED certificate is all you need to have to get most bank teller jobs.

But—

Whatever education level you have, you need to add it to your resume for bank tellers correctly if you want to get deep in the money and land the job.

So, here’s how to do it.

When you have plenty of experience as a bank teller, keep the details of your college or high school history to a minimum.

| Right |

|---|

Bachelor of Business Administration in Finance Florida International University, Miami, FL Completion: 2017 |

However—

When you’re writing a resume with less experience, or none at all, list extras, such as relevant classes, achievements, and extracurriculars:

| Right |

|---|

Bachelor of Science in Finance and Accounting Management Northeastern University, Boston, MA Completion: 2016 Relevant Coursework: Applications for Managerial Finance, Advanced Financial Recordkeeping & Accounting Practices, Financial Management. Minor: English Studies |

If you have a college degree under your belt, skip high school on your bank teller resume.

Also, if you have no experience (or very little), swap places, education for work history. This way you’ll put the most impactful items on the top for the bank manager to see first.

Read More: How to Include Education History on a Resume

4

You’ve got a bank vault’s worth of skills in your arsenal.

But you can only list a few.

Which banking skills to list on resumes for bank teller jobs?

Here’s what you should do:

Let’s begin by looking at common bank teller resume skills:

Next—

Let’s have a look at how to put your bank skills on a teller resume:

| Right |

|---|

|

| Right |

|---|

|

Simple, right?

Whether you’re Jamie Dimon or just starting out in the world of finance, you definitely have skills relevant for resumes for bank tellers.

Read more about adding skills on a resume: How to Add a Skills List to a Resume.

5

Extra bank cashier resume sections help to set you apart from the other qualified bank job candidates.

Here are a few examples to consider:

Certificates prove you have skills when your college and past work experience doesn’t.

If you have a volunteer job in your past, that’s potentially great experience to list on bank teller resumes.

Knowledge of a second language is powerful, especially for a customer-facing job such as those at a bank.

Hobbies and interests can look great, but be sure to choose those passions which have at least a little to do with bank jobs.

6

The heading statement goes at the very top of your banker resume.

Because it’s the first thing the bank manager or branch supervisor will see, you need one you can bank on.

There are two types: the summary and the objective.

Are you a seasoned teller?

A summary on a resume is perfect for you.

A career summary shows the finance director or banking manager that you have plenty of experience under your belt and the skills to do the bank proud. It also includes a numbered achievement to quantify one (or more!) of your proudest past wins.

Take a gander at these two banking resume examples of summary statements:

| Right |

|---|

Personable bank teller at high-volume bank with 5 years of expertise with financial customer service. 99.75% client happiness rating over 5-year period of employment. Seeking to leverage knowledge of advanced banking tasks and banking product experience to become the next senior bank teller at Global Savings Bank. |

| Wrong |

|---|

| As a veteran bank teller, I know I have the skills and experience necessary to perform standard banking and transactional duties at any bank branch of any financial institution. |

The wrong example above is way too generic to get more than a passing glance.

The right example, on the other hand, has everything needed to impress the bank supervisor and vault right to the top: a tailored approach, powerful details, and a numbered win.

But—

How about when this is your first job at a bank branch?

In this case, an objective on a resume is right for you.

A career objective introduces you with a compelling statement about your professional background and a mention about your career goals. It also includes a past win that uses numbers to show them what you bring to the table.

Have a look at these two bank teller resume examples of objective paragraphs:

| Right |

|---|

Current college student majoring in finance with 3 years of experience at a retail store with heavy traffic. Excellent customer service, communication, and interpersonal skills. 100% score on Bank Teller Certification Exam. Seeking to use client-centered skills and retail experience to become a junior bank teller at Overseas Investment Bank. |

| Wrong |

|---|

While I finish up my bachelor’s degree, I’m looking for a part-time bank teller job to tide me over financially. I haven’t worked at a bank before, but I have lots of retail skills which translate well to jobs at banks. |

Which candidate would you prefer? The choice is obvious.

Read more: How to Write a Powerful Resume Opening Statement

7

Want the bank manager to give your application a fair value when auditing it?

Here’s how to write a bank teller cover letter:

Cover letters for bank teller jobs give you freedom to talk about things your resume couldn’t, such as an employment gap or showing enthusiasm for finance.

Like finding a tax deduction, use it to your advantage!

To get some helpful advice: 35+ Successful Cover Letter Tips

Plus, a great cover letter that matches your resume will give you an advantage over other candidates. You can write it in our cover letter builder here. Here's what it may look like:

See more cover letter templates and start writing.

Let’s do some arithmetic and sum this all up.

Here’s how to write a bank teller resume step-by-step:

We’d love to hear from you:

Leave us a comment below and let’s have a discussion. Thanks for reading!

A step by step guide to writing a professional resume for financial analyst. Use our financial analyst resume sample and a template.

Using a reverse-chronological resume is the way to go in the vast majority of cases. But only if you know exactly how to make this particular resume format work for you.

Interview coming up, and you just don’t know what to expect? Here’s a compilation of the most common interview questions that you might hear and how to answer them.

![Reverse Chronological Resume Templates [Ideal Format]](https://cdn-images.zety.com/pages/chron.jpg?fit=crop&h=250&dpr=2)