Job Hunting Nightmares: What Are Recruiters Doing Wrong?

The Great Resignation means major job ad scouring. Cringeworthy job ads and nightmare recruiters won’t cut it anymore! 1000+ American workers share the no-nos.

![Do You Want to Get Paid in Crypto? [2022 Study]](https://cdn-images.zety.com/pages/get_paid_in_crypto_zety_us_9.jpg?fit=crop&h=650&q=75)

Cryptocurrencies. A controversial topic, especially when receiving a salary. Or maybe a great opportunity and a missed chance? Here’s what people think about getting paid in crypto.

Feeling like regular cash payment or bank transfer is not enough? Just like they were overrated? Just like they keep you from gaining more?

It doesn't have to be like this ever again.

ABBA’s rhythmic Money, money, money, must be funny, in the rich man's world beat resonates in your head.

You're racking your brain for investment opportunities, transferring money to various savings and profits deposits, investing in mutual funds, or buying gold. Or you do nothing, patiently waiting from month to month for the money transfer that will feed your account and increase your mere four-figure sum.

Forget it.

The new salary trend is already here. And depending on your point of view it’s either high risk or high reward. What is that?

Cryptocurrencies!

And to be more specific, getting your monthly paycheck and bonuses via digital coins.

A terrible idea, you say? Maybe not for everyone as 80% of our respondents would like to receive their salary or bonuses in crypto.

But let’s not get ahead of ourselves. This fascinating finding comes from a survey of 950+ US respondents. We asked them their opinions about getting paid in crypto and the risks and opportunities that creates.

However, we should make one little disclaimer before we start. Our respondents showed a very positive view of crypto in general, more so than previous studies of a similar nature. Therefore, we have to point out that this survey may have attracted people with a positive view of crypto in the first place.

That said, crypto ownership grew three-fold in the years 2018–2021 and shows no signs of slowing. So interest in this topic is only going one way, regardless of the demographics of our respondents.

Okay, so now we can keep scrolling to discover more.

Yes, it does.

But, in the internet era, with information circulating the world within seconds, it's hard not to know what cryptocurrencies are. You can hardly avoid hearing about all the crypto dramas, especially if famous names are involved, like Elon Musk tweeting about cryptocurrencies and affecting their value. Or Bill Gates warning against Bitcoin and calling it “one of the crazier, speculative things.” And even Warren Buffett describing it as “rat poison.”

Cryptocurrencies are trending. And our findings prove it.

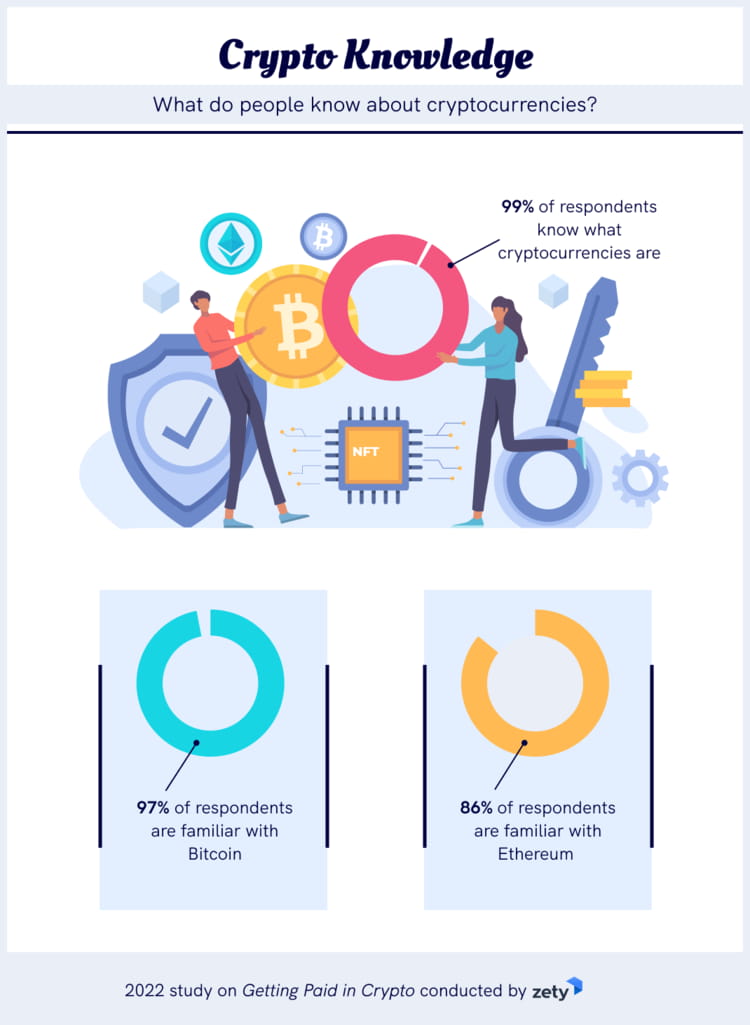

99% of our respondents know what cryptocurrencies are.

With such a crypto buzz, it’s not surprising that our respondents can also name the most popular digital coins. For sure, it's hard not to be familiar with the "father" of crypto, Bitcoin. 97% of our survey takers know it. Ethereum also has a similarly high familiarity rate, at 86%.

However, that's not all. Our respondents were also familiar with other cryptocurrencies, such as:

Notably, only 9% of respondents did not know a single coin from the list we presented.

There are also plenty of people who not only know some digital coins but also hold and invest in them.

New York Digital Investment Group supplements this information by reporting that 22% of adults owned Bitcoin in 2021. That’s roughly 46 million Americans.

Our survey also checked whether respondents hold any digital coins or invest in crypto. Almost 84% said “yes” to both questions in our case. Again, it is worth emphasizing our proviso about our respondents.

Either way, we cannot deny the popularity of cryptocurrencies or the fact that interest in them continues to grow.

They have conquered the retail investment market. And they did it years ago. But now, when everyone who could afford to create their own crypto tokens (like Manchester United Fan Token or Squid Game Token) has already made them, the world has come up with a new idea—receiving monthly payments in cryptocurrencies.

It can't be a bad idea, as it has already attracted some big names. New York City Mayor Eric Adams decided to convert his first three paychecks into Bitcoin and Ethereum, while Mayor of Miami Francis Suarez went for one paycheck. Two footballers, Aaron Rodgers (Green Bay Packers) and Russell Okung (former NFL player), both took a portion of their salary in Bitcoin.

And what attitude do our respondents have towards their paychecks being paid out in cryptocurrencies?

As you can see, our respondents are pretty open to receiving salaries and bonuses in cryptocurrencies.

73% rate the idea of getting paid in crypto as good or very good. Only 8% are strongly against it, while 17% have a neutral attitude.

Furthermore, 8 out of 10 survey takers are open to receiving their salary or bonuses in digital coins.

This open approach to getting a salary or bonus in crypto is quite surprising. So we decided to dig deeper and find out what remuneration option would our respondents would choose. We discovered that:

So now, we can put respondents into specific groups according to their preferred remuneration options. Consequently, we see that only 1 in 5 respondents (21%) would like to receive all payments in crypto. At the same time, nearly half, 40%, would go for a combination of both.

All things considered, we’re still looking at a pretty positive attitude towards getting a crypto paycheck. So where does this optimism come from?

We’ve assumed that our respondents are familiar with this market and know its potential. Hence, they are seriously considering the option of receiving compensation in crypto.

But maybe they already have a practical experience with crypto salary and bonuses? This is a question we addressed to our respondents. And the answer is yes.

75% claimed that they received a salary or bonus in digital coins at least once. And 98% of those who have received compensation in crypto observed an increase in its value.

At first, we were surprised that so many respondents claimed they’d been paid in crypto. However, this can be explained if we make a certain assumption. Respondents did not necessarily receive a direct crypto transfer from employers, they might have as well converted their salary, or a portion of it, into crypto after getting paid.

For sure, they did not listen to Bill Gates and Warren Buffett or any other analysts and economists' warnings. They took a risk, and it certainly worked out for some.

If an employee is receiving their salary in Bitcoin, they might as well be receiving lottery tickets. They are just participating in a game.

Certainly, crypto investments are a risky game. But investors (or should I say gamers?) are aware of this. No newbie to the cryptocurrency market would decide to receive a salary in digital coins or exchange it right after. And those who decided to do so know the game and its stake. They made their in-depth analyses, weighing all the pros and cons.

Any person with even a slight knowledge of cryptocurrencies can easily list at least one advantage and disadvantage of receiving money in digital coins.

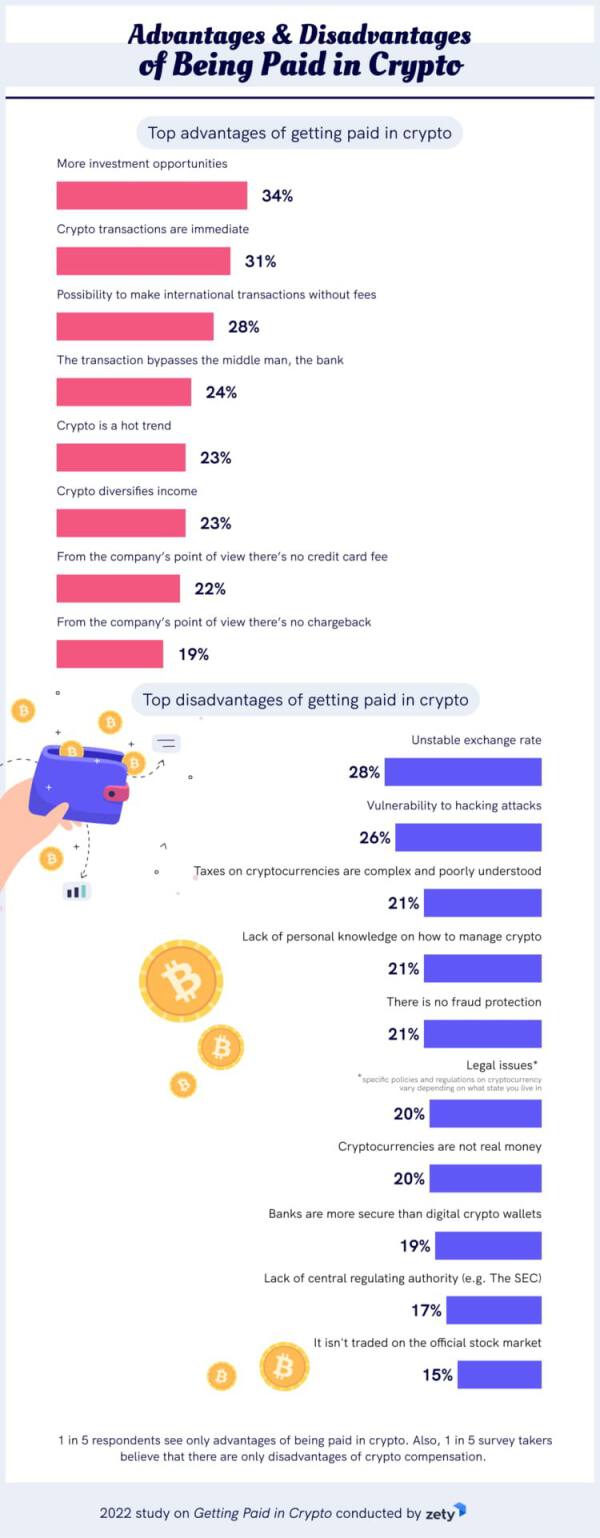

Our study wanted to determine which pros and cons respondents weigh most in their considerations about crypto compensation. Their most commonly perceived pros and cons are listed above.

It is worth noting that both bright and dark sides were indicated with similar frequency. But still, advantages were more frequently indicated than drawbacks.

The top benefit to being paid in crypto, according to our respondents, is an increased number of investment opportunities (34%).

Jonathan Chester, founder of Bitwage, a platform for converting salaries into cryptocurrency, would agree with them.

People see this as a way to get a higher salary in the long term. Basically, get paid today, and have a savings account that accrues as opposed to losing money if it were just sitting as dollars.

The transactions speed follows the already mentioned investment opportunities. Our respondents (31%) underlined that crypto transactions are immediate, as we don't have to wait for banks to process the payment.

Other commonly perceived benefits of crypto compensation are the possibility to make international transactions without fees (28%), bypassing the middleman, the bank (24%), diversifying income (23%), and crypto being a hot trend (23%).

The list closes with some positives from the employer's angle. These are lack of credit card payment fee (22%) and lack of chargeback (19%).

That's it as far as the pros are concerned. We can summarize them by quoting Jack Mallers, CEO of Strike, a digital finance company.

[Bitcoin] allows us to save and outpace inflation, it allows us to remit money to countries where previously fees are 50% and allows us to live externally of any central body or authoritarian regime.

Let us now proceed to the other side of the (crypto) coin—the disadvantages of crypto compensation. According to the respondents, there are also plenty of them.

The main one is the unstable exchange rate of cryptocurrencies (28%), which is followed by vulnerability to hacking attacks (26%).

Third place went to three winners: the complexity of tax regulations, lack of personal knowledge on managing crypto, and lack of fraud protection (21% each).

The list of negative crypto aspects finished off with:

Loni Mahanta, a nonresident fellow in Economic Studies at Brookings, sums up the disadvantages of crypto well.

For those who were receiving their earnings three months ago, six months ago, and have now faced this crash, they're still paying taxes on that much higher value," she said. "They get taxed at that higher amount, regardless of the volatility of the up and down. And so, I think a question for the policymakers and anybody that's sort of receiving their compensation in Bitcoin is: Do they fully understand the tax implications?

Here we finish our consideration of crypto compensation pros and cons. Both crypto enthusiasts and skeptics made their points. Positive opinions balance out with negative ones. And it's good to have people who highlight the pros and cons of crypto payments.

Lastly, let's just mention that 1 in 5 of our respondents sees no disadvantages at all of being paid in crypto. On the flip side, 1 in 5 survey takers sees no advantages at all.

It’s good to have them too.

But is it good to have employers willing to pay in crypto?

As it is already well-known, crypto payments have their supporters and opponents. There is no shortage of people who will take up the experiment and opt for payment or part of it in digital coins. Conversely, some will never be convinced of such an idea.

Regardless of the difference of opinion, how could the crypto mindset of employees affect employers?

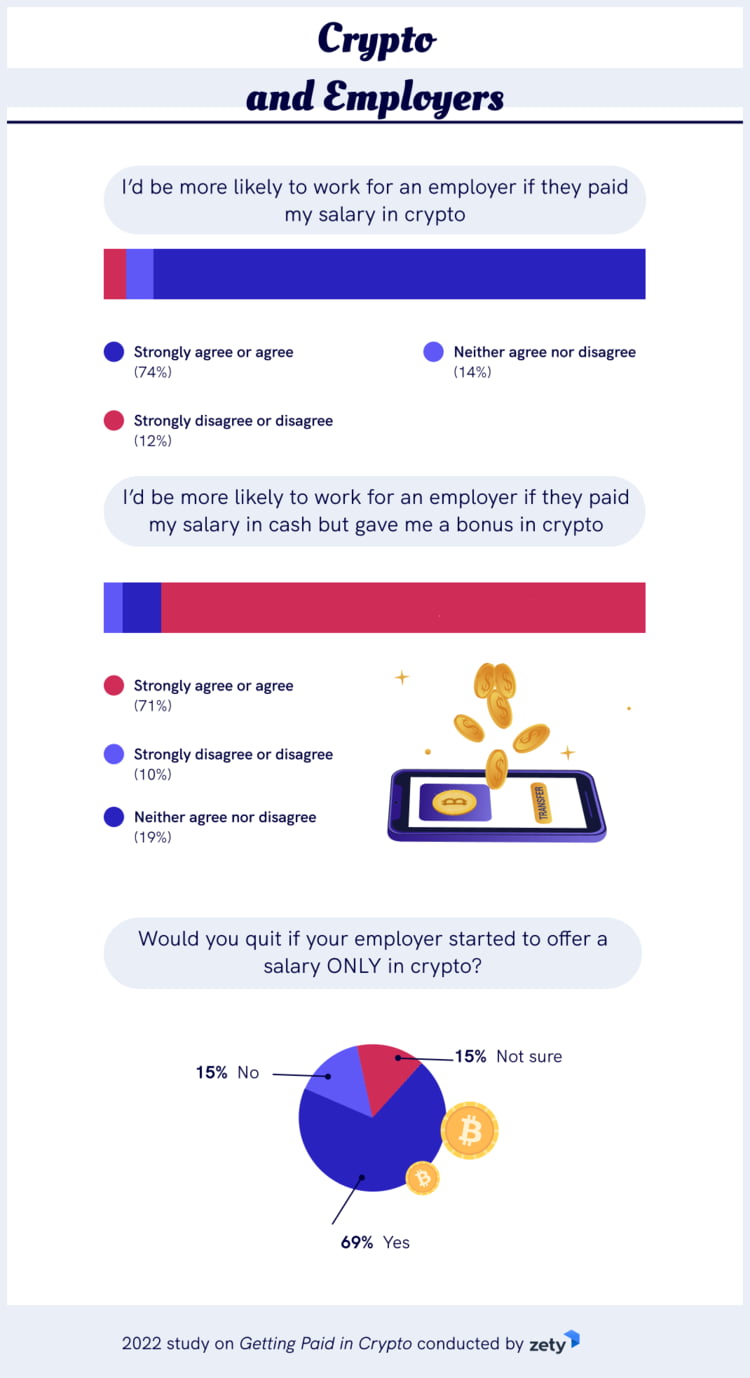

74% would be more likely to work for an employer if they paid a salary in crypto.

Also, 71% would be more likely to work for an employer if they paid bonuses in crypto.

Let’s note here that the option to receive a salary or bonuses in crypto is voluntary. It is the employee's choice whether to accept compensation in digital coins. The employer only provides this option. That makes an employee more willing to work for a certain employer.

In this sense, crypto compensation is perceived as one of the employee benefits, just like health care or sports packages.

And like all good benefits, employees like to be able to choose what works for them.

So it’s not surprising that employees wouldn’t want to work for a company that doesn’t offer traditional compensation.

When we asked our respondents if they would quit if their employer started to offer a salary ONLY in crypto, 69% said yes.

So flexibility and choice are key when it comes to crypto-based benefits.

Getting paid only through cryptocurrencies highlights all the downsides and concerns employees have about it. The volatility of the currency or the lack of legal and tax regulations suddenly overshadows all the pros.

This confirms that the area of crypto compensation still has many mysteries that need to be discovered and regulated first.

But you never know…

Many wonder about the future of digital coins. They have already proven to be a source of great earnings and a significant financial loss.

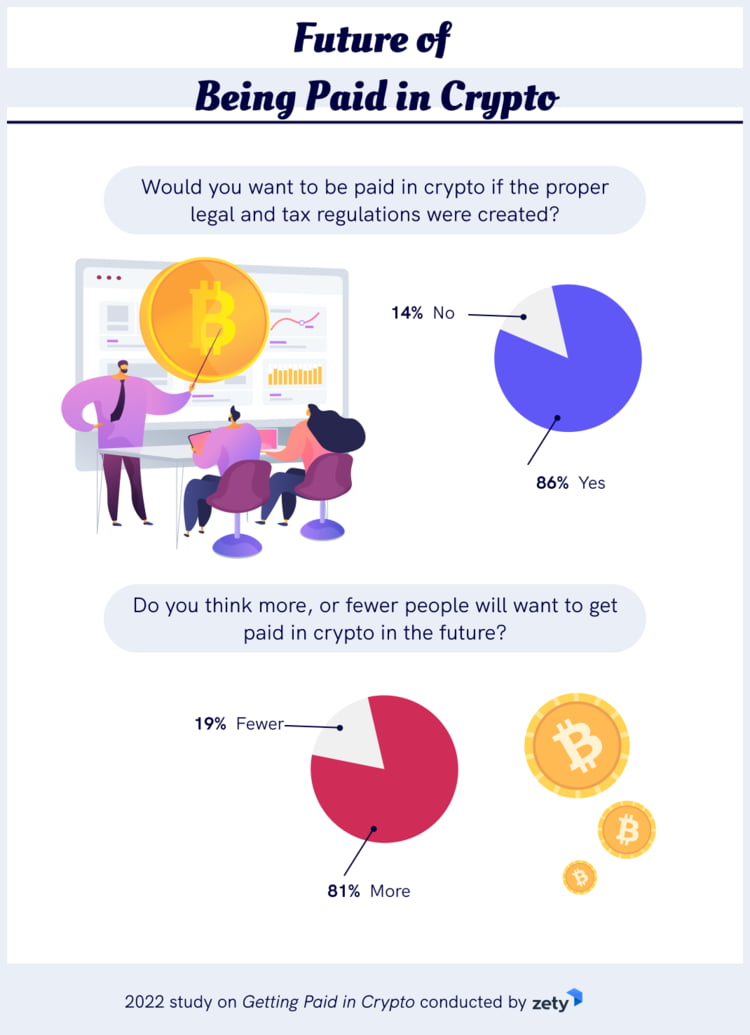

The stabilization and regulation of the market are certainly awaited by those hesitant and not totally convinced about getting paid in crypto.

The study shows that 86% of our respondents would want to be paid in crypto if the proper legal and tax regulations were created.

At the same time, 81% think that more people will want to get paid in crypto in the future.

Let's look at some statistics that prove these predictions to be real.

Looking at these numbers, it's hard not to start asking yourself whether you should invest in crypto.

The high percentage of employees who speak positively about crypto payouts and claim that more and more people will follow in their steps in the future is even less surprising. Undoubtedly, their opinions show the strength of the crypto market and the expectations people have for increasing returns from investments.

The crypto market has potential. It may become the future of payments if regulated, from receiving salary and bonuses to online shopping.

But is crypto the only alternative payment option? The answer is no.

The digital payment industry is growing steadily, with new digital coins constantly appearing on the market. For investors, it’s not enough. Some time ago, they came up with alternatives to the standard crypto coins—NFTs.

A non-fungible token (NFT) is a non-interchangeable unit of data stored on a blockchain that can be sold and traded. They exist on a blockchain and cannot be replicated. NFT data units may be associated with digital files such as photos, videos, and audio.

So basically, these are photos, images, music files, or even tweets that have a particular value and can be bought and sold.

Following NFTs trends, we also wanted to dive deeper into this area. Obviously, we were not interested in general NFTs knowledge. For our respondents, we had three specific questions.

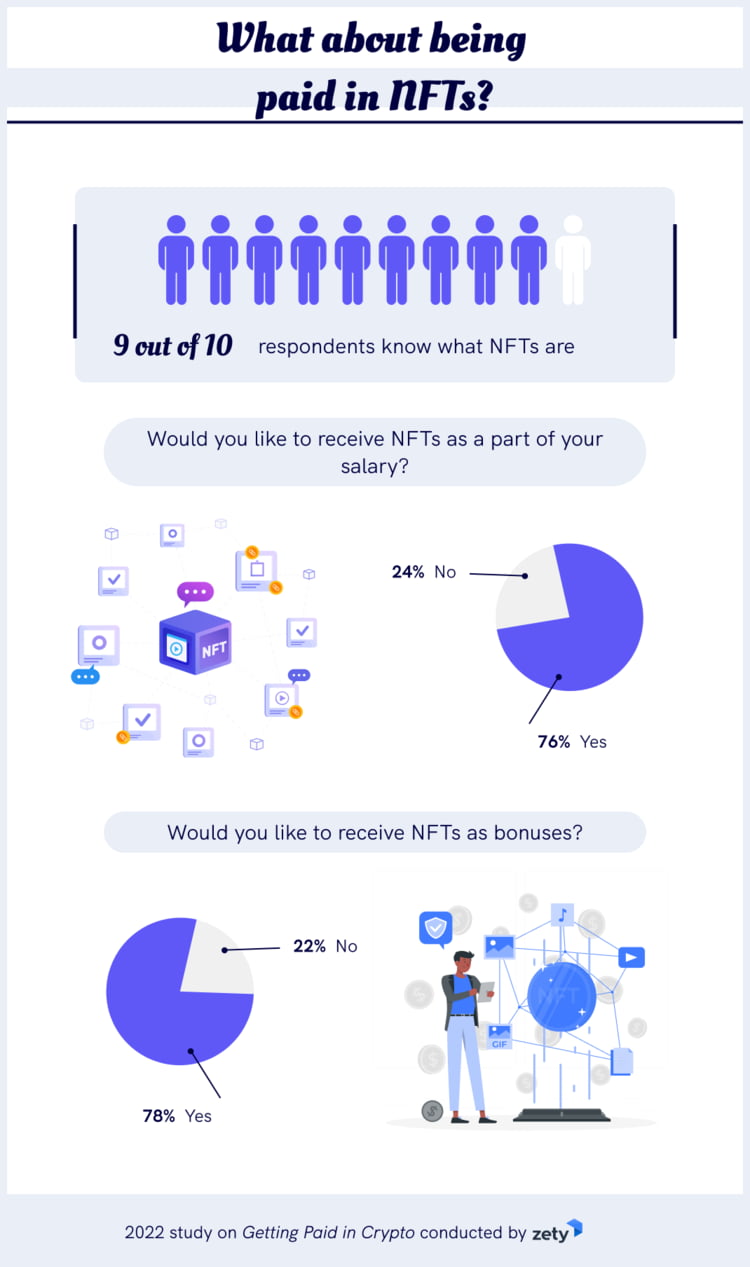

First, we wondered how many people had heard of NFTs. Respondents' knowledge didn't fail on this topic either.

Why? 9 out of 10 respondents know what NFTs are. So, they are as popular as cryptocurrencies.

Moreover, people see the potential in NFTs received as part of a salary (76%) or bonus (78%). This gives us almost 8 in 10 employees who would like to receive NFTs as compensation.

Along with cryptocurrencies, NFTs may yet surprise us.

People are buying and selling NFTs today, and 99% of the people in this world are not aware of this billion-dollar market, and this opportunity is really a once in a century opportunity.

Let's make it clear. Crypto salaries don't exist on a large scale and will certainly not overcome the popularity of traditional methods of paying for work. But still, getting paid in cryptocurrencies is real. Whether we're talking about some part of salary or bonuses, the crypto compensation market has great potential.

Let’s have a quick rundown of the study's key findings:

With that in mind, we may say that crypto's full potential will surely be revealed as it attracts more and more employees and employers. Appropriate legal and tax regulations will also play their parts.

But we still have a lot to learn. Quoting Anuj Jasani again:

People don’t understand NFTs, Metaverse, and crypto today the same way they didn’t understand online shopping in the 1995.

We surveyed 950 unique respondents via a bespoke online polling tool. All respondents included in the study passed an attention-check question. The study was created through research, crowdsourcing, and surveying.

Now when you have reviewed the results of our study, one thing needs to be noted. Looking at the results, we may have attracted a high proportion of respondents with an existing interest in crypto. Why do we think so? Based on two questions. We asked our respondents two questions: “Do you hold any cryptocurrency?” and “Do you invest in cryptocurrencies?”. Almost 84% of our respondents hold and invest in cryptocurrencies based on the answers. We know that these numbers are very high compared to previous studies. So we can deduce that our respondents represented a group of people who are much more involved in the cryptocurrency market.

The data we are presenting relies on self-reports from respondents. Each person who took our survey read and responded to each question without any research administration or interference. We acknowledge there are many potential issues with self-reported data like selective memory, telescoping, attribution, or exaggeration.

Some questions and responses have been rephrased or condensed for readers’ clarity and ease of understanding. In some cases, the percentages presented may not add up to 100 percent; depending on the case, this can be due to rounding, or due to being part of a larger statistic.

Whether you want to receive your salary or bonuses in crypto or not, feel free to share our findings! All we ask is that you link back to this page and give full credit to our authors.

Zety is a blog about career development that will cover the basics and more. Learn how to write a resume based on various resume samples (including IT resume examples), complete it with a cover letter, and get ready to win your next job interview.

The Great Resignation means major job ad scouring. Cringeworthy job ads and nightmare recruiters won’t cut it anymore! 1000+ American workers share the no-nos.

Love doctors but hate politicians? You’re not alone. Some jobs are more respected than others. Find out which careers are most esteemed and what makes a job worthy of respect.

Feeling controlled? Today’s workplace surveillance is a digital playground. Employers can track employees' every move. Here’s what people really think about Big Brother watching them.

![How Do Employees View Workplace Surveillance? [2022 Study]](https://cdn-images.zety.com/pages/workplace_surveillance_zety_us_9.jpg?fit=crop&h=250&dpr=2)